Colliers Report: South Carolina absorption on track to double 2018 absorption total

August 12, 2019

Research & Forecast Report

SOUTH CAROLINA | INDUSTRIAL Q2 2019

Key Takeaways

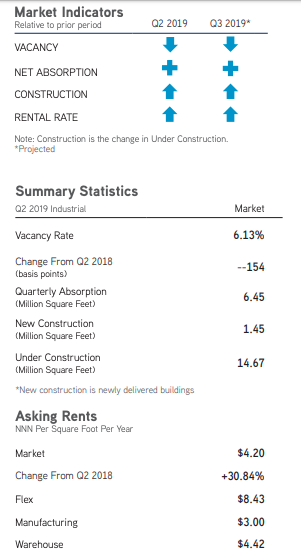

- South Carolina industrial markets have already surpassed the total absorption for last year – this quarter alone, the state absorbed 6.45 million square feet.

- Rental rates continue in an upward trend and averaged $4.20 per square foot during the second quarter of 2019.

For additional commercial real estate news, check out the market reports here.

Decentralized distribution hubs drive South Carolina demand

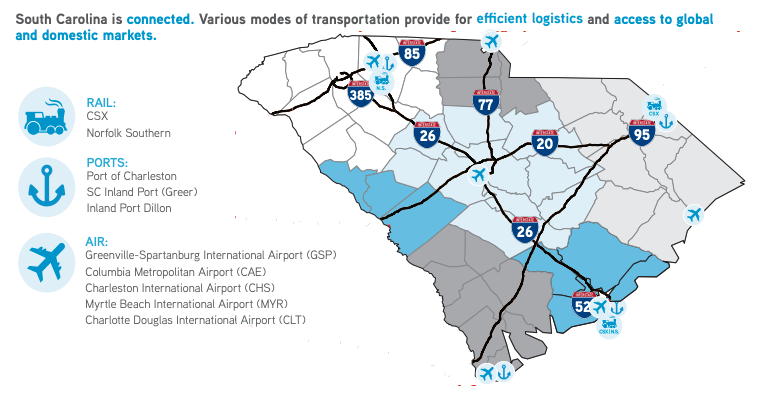

The decentralization of distribution hubs is a direct result of suppliers meeting the delivery demands of consumers within hours to one day of their orders, rather than having one main hub that delivers within a few days. This shift has driven the industrial demand up throughout South Carolina because the entire state has access to logistical suppliers such as the Port of Charleston and the Inland Ports of Dillon and Greer. It follows then that industrial occupiers desire a location within regions with the highest population growth and, according to the most recent U.S. Census data, South Carolina’s population is expected to increase to 5.46 million people by the year 2020.

The decentralization of distribution hubs is a direct result of suppliers meeting the delivery demands of consumers within hours to one day of their orders, rather than having one main hub that delivers within a few days. This shift has driven the industrial demand up throughout South Carolina because the entire state has access to logistical suppliers such as the Port of Charleston and the Inland Ports of Dillon and Greer. It follows then that industrial occupiers desire a location within regions with the highest population growth and, according to the most recent U.S. Census data, South Carolina’s population is expected to increase to 5.46 million people by the year 2020.

Rising industrial demand is evidenced through the absorption numbers over the past year and a half. Last year, the South Carolina industrial market absorbed 12.84 million square feet and already this year that number has been surpassed; 13.47 million square feet have been absorbed across the state in the first two quarters. Absorption is expected to continue trending  upward throughout the year as demand rises and more manufacturers and distributors locate throughout South Carolina.

upward throughout the year as demand rises and more manufacturers and distributors locate throughout South Carolina.

Market Overview

The South Carolina industrial market is comprised of 433.33 million square feet within 6,878 buildings.

From the first quarter through the second quarter of this year, the South Carolina market grew by nine buildings which added approximately 1.45 million square feet. In addition, there are 14.67 million square feet under construction and 4.14 million square feet of proposed industrial buildings throughout the market. Despite the delivery of new industrial construction, the South Carolina industrial markets absorbed approximately 6.45 million square feet during the second quarter of 2019 and the overall South Carolina market vacancy rate dropped from 7.13% during the first quarter of 2019 to 6.13% this quarter. The average triple net South Carolina market rental rate for the remaining available industrial space increased to $4.20 per square foot during the second quarter of this year.

Augusta | Aiken (South Carolina portion): Positive manufacturing absorption

The South Carolina portion of the Augusta | Aiken market is comprised of 13.59 million square feet, over half of which is manufacturing space. No new industrial buildings were delivered to this market; however, the 40,000-square-foot AmbioPharm expansion continued construction. The Augusta | Aiken market posted a net negative absorption of 290,872 square feet this quarter, primarily due to the 316,145 square feet of net negative warehouse absorption. Consequently, the overall market vacancy rate rose to 13.61% during the second quarter of 2019. Augusta | Aiken manufacturers absorbed 25,273 square feet this quarter. The average weighted rental rate for the South Carolina portion of the Augusta | Aiken region increased from $2.60 per square foot to $2.85 per square foot this quarter.

Charleston: Increasing absorption and new construction expected

The Charleston industrial market has 55.64 million square feet of industrial inventory with approximately 4.05 million square feet under construction within 23 buildings. In addition, there are approximately 3.78 million square feet of buildings proposed to be built within the Charleston market. There were three new buildings delivered to the market this quarter which added 470,630 square feet to the Charleston industrial inventory. The Charleston industrial market absorbed 632,810 square feet during the second quarter of 2019; three submarkets: North Charleston, Berkeley County and Clements Ferry absorbed a net total of 540,875 square feet. However, the overall market vacancy rate increased slightly from 8.15% during the first quarter of this year to 8.71% this quarter. The overall market average triple net weighted rental rate dropped slightly this quarter to $5.95 per square foot.

Charlotte (South Carolina portion): High absorption despite construction delivery

The South Carolina portion of the Charlotte submarket has an industrial inventory totaling 35.54 million square feet, and there are currently 1.31 million square feet of warehouse and flex space currently under construction. One 370,000-square-foot warehouse delivered to the market this quarter in York County. The South Carolina portion of the Charlotte market absorbed 1.28 million square feet during the second quarter of 2019, led by the warehouse absorption of 1.14 million square feet. The overall quarterly market vacancy rate decreased from 10.35% to 7.97%. Average weighted rental rates for the remaining industrial space rose from $5.50 per square foot last quarter to $5.69 per square foot during the second quarter of 2019.

Columbia: New construction will be quickly absorbed

The Columbia industrial market is comprised of 71.29 million square feet of industrial space. There are approximately 1.20 million square feet under construction within six buildings. The Columbia industrial market absorbed 757,094 square feet this quarter, led by the Orangeburg County submarket which absorbed 317,203 square feet. The overall market vacancy rate dropped from 6.88% during the first quarter of 2019 to 5.82% this quarter. Also, the overall average market rental rate for the remaining available space increased from $3.85 per square foot last quarter to $3.92 per square foot during the second quarter of 2019.

Florence | Myrtle Beach: Vacancy rate half of last quarter

The Florence | Myrtle Beach market is comprised of 37.17 million square feet of industrial properties and absorbed over 1.67 million square feet during the second quarter of 2019. Warehouses absorbed 987,421 square feet and manufacturers absorbed 684,579 square feet. Due to the immense positive absorption, the vacancy rate was nearly half of what it was last quarter – it dropped to 6.42%. During the second quarter of 2019, warehouse vacancy was 4.05%, lower than it has been for over a year. Construction continues on two warehouses which, upon completion, will add 291,700 square feet to the market. The overall Florence | Myrtle Beach weighted rental rates increased from $2.42 per square foot to $2.85 per square foot this quarter mainly due to manufacturing rental rates rising to $3.42 per square foot.

Greenville-Spartanburg: Construction delivery and positive absorption

Comprising approximately 206.88 million square feet, there are currently 8.68 million square feet in 15 buildings under construction and 4 additional proposed properties totaling 936,677 square feet throughout the Greenville-Spartanburg market. During the second quarter of 2019, 735,101 square feet of industrial buildings were delivered to the market and 2.49 million square feet absorbed. Consequently, the quarterly market vacancy rate dropped from 5.28% to 4.36%. The overall average weighted quarterly market rental rate rose 2.36% to $3.90 per square foot.

In general, Class A warehouse space ranges from $4.35 per square foot, triple net, to $4.75 per square foot, triple net, depending on the amount of customization or upfit required. Manufacturing space depends heavily on the user’s required improvements and range from $4.75 per square foot, triple net, to $5.50 per square foot, triple net. Class B warehouse and manufacturing space ranges from $3.50 per square foot, triple net, to $4.35 per square foot, triple net. Class C space is the most variable in regard to rate and business terms. These spaces are typically older, with some form of functional obsolescence, such as clear ceiling height under 18’, metal or masonry shell, deferred building maintenance, etc. Rates on these spaces are typically under $3.50 per square foot, triple net, and in some cases are offered as modified gross leases.

Savannah (South Carolina portion): Positive second quarter

The Savannah market within South Carolina has 10.21 million square feet of industrial space and absorbed 181,715 square feet during the second quarter of 2019. There are 40,000 square feet under construction and 31,200 square feet of warehouse space delivered to the market this quarter. The overall quarterly vacancy rate dropped from 9.27% to 8.02% this quarter and the average triple net weighted rental rate increased to $2.93 per square foot.

Significant Transactions

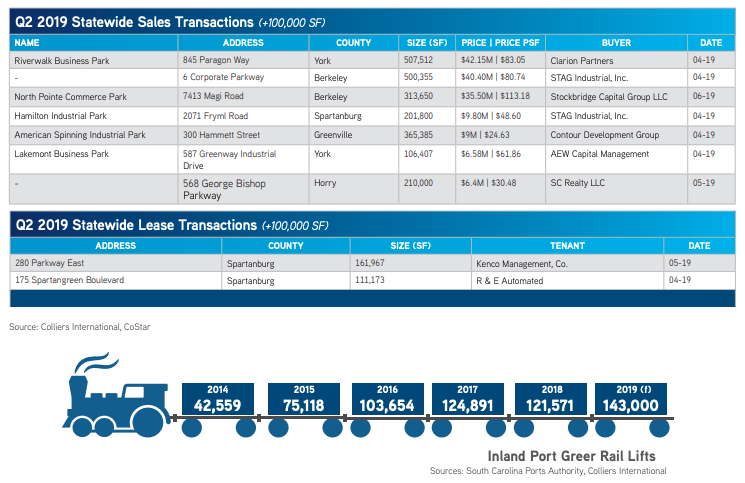

There were 133 industrial sale transactions reported through CoStar during the second quarter of 2019, including a $407.52 million, six-property portfolio sale including a West Columbia industrial property. There were 85 lease transactions during the second quarter of 2019, all but nine were under 100,000 square feet.

The South Carolina Ports Authority continue to report record-high numbers throughout South Carolina ports. Consequently, manufacturing and warehouse activity is intensifying with no signs of slowing in the near future. Statewide industrial absorption has already surpassed the total absorption of 2018. New construction demand is high and speculative warehouse and manufacturing facilities are absorbed quickly upon completion.

The Greenville-Spartanburg market is being seen by many users and logistics providers as an emerging industrial hub and an alternative to regional competitors. The Charleston industrial market plays a large role in the logistics chain due to the continued construction of the deepest eastern seaport in the U.S., and Columbia’s central location will continue to expand through speculative construction growth. Throughout South Carolina, industrial activity is escalating as manufacturers and distributors locate to the region and, despite a large pipeline of anticipated construction completion, the market demand is strong enough to continue trending upward.

For additional commercial real estate news, check out the market reports here.