Colliers Report: South Carolina Construction Starts Decline

September 2, 2020Research & Forecast Report

Q2-2020 SOUTH CAROLINA | CONSTRUCTION TRENDS

Key Takeaways

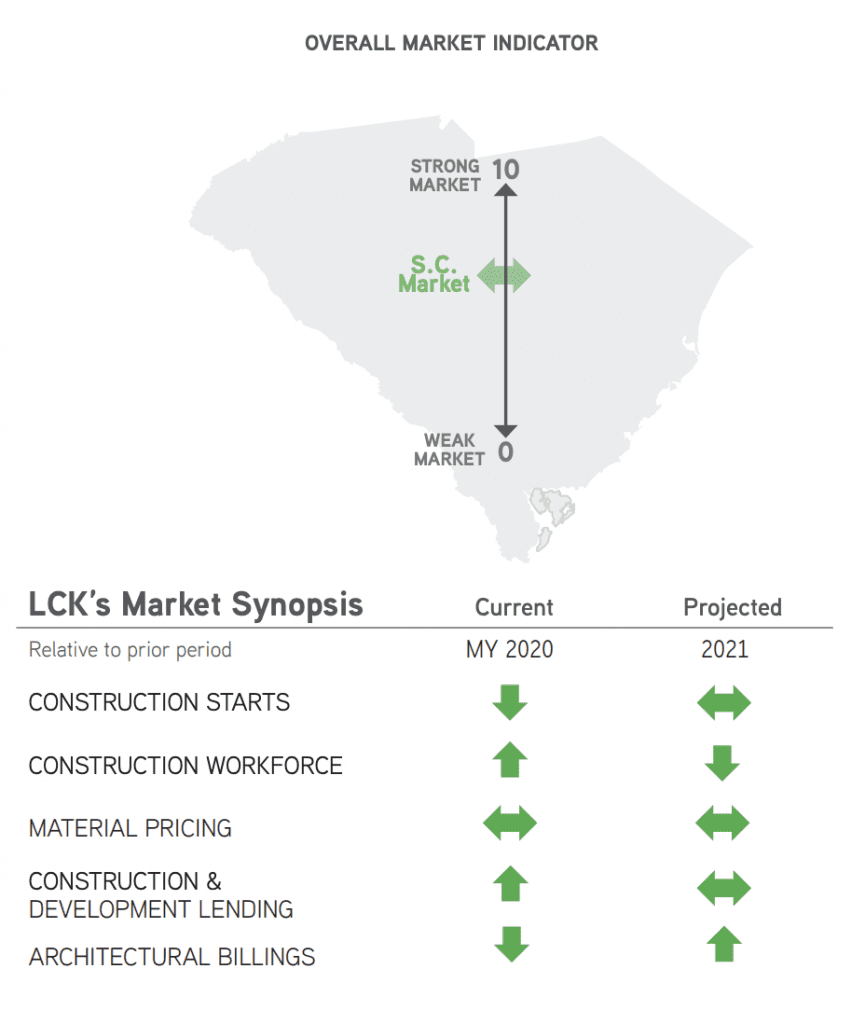

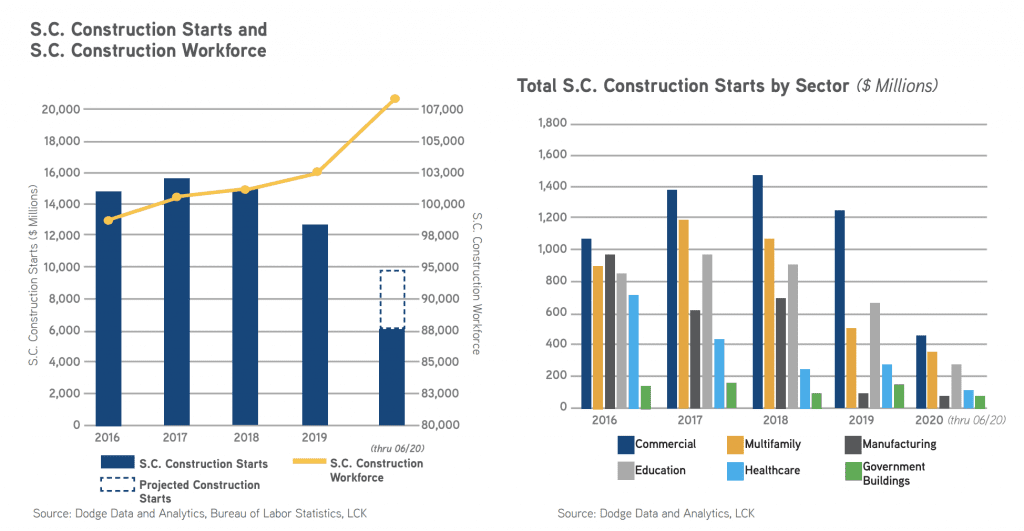

- Statewide construction starts and regional architectural billings have decreased sharply during the first half of 2020. If starts and pre-development activities do not increase during the third and fourth quarters, the construction market is likely to experience a marked slowdown in 2021.

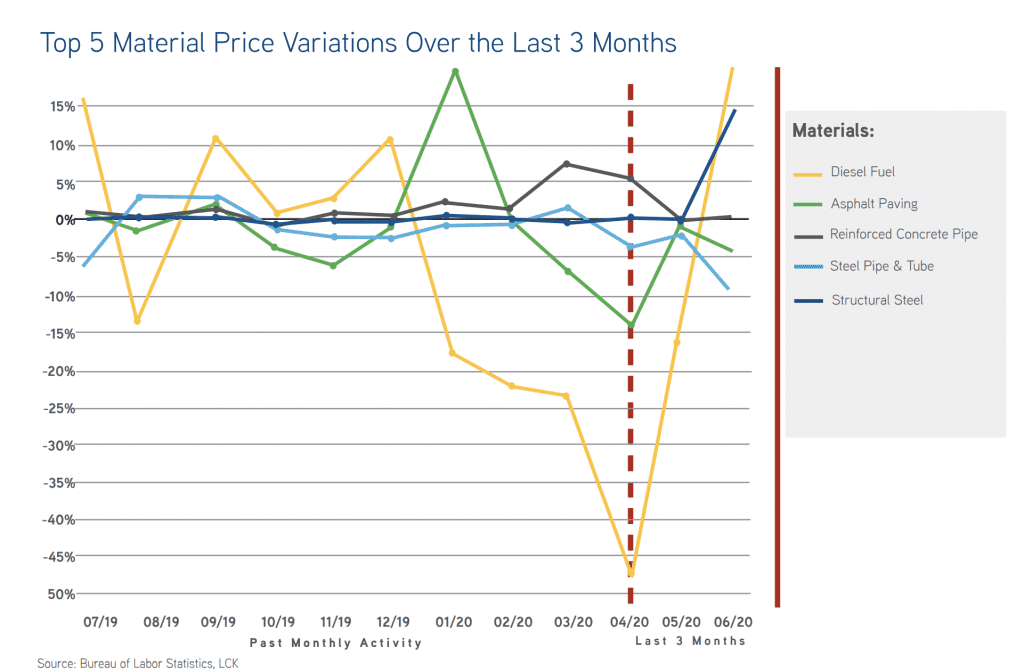

- Construction costs overall are expected to decrease as projects have been put on hold and new starts are inadequate to replace the current pipeline. Material pricing is somewhat volatile with availability and prices fluctuating depending on the commodity.

- LCK Construction Tip: South Carolina’s construction market is beginning to lean toward the buyers’ favor as general contractors are eager to secure new projects. Because of the decline in new starts, more subcontractors are bidding work resulting in more competitive pricing.

For additional commercial real estate news, check out our market reports here.

For additional commercial real estate news, check out our market reports here.

Overview

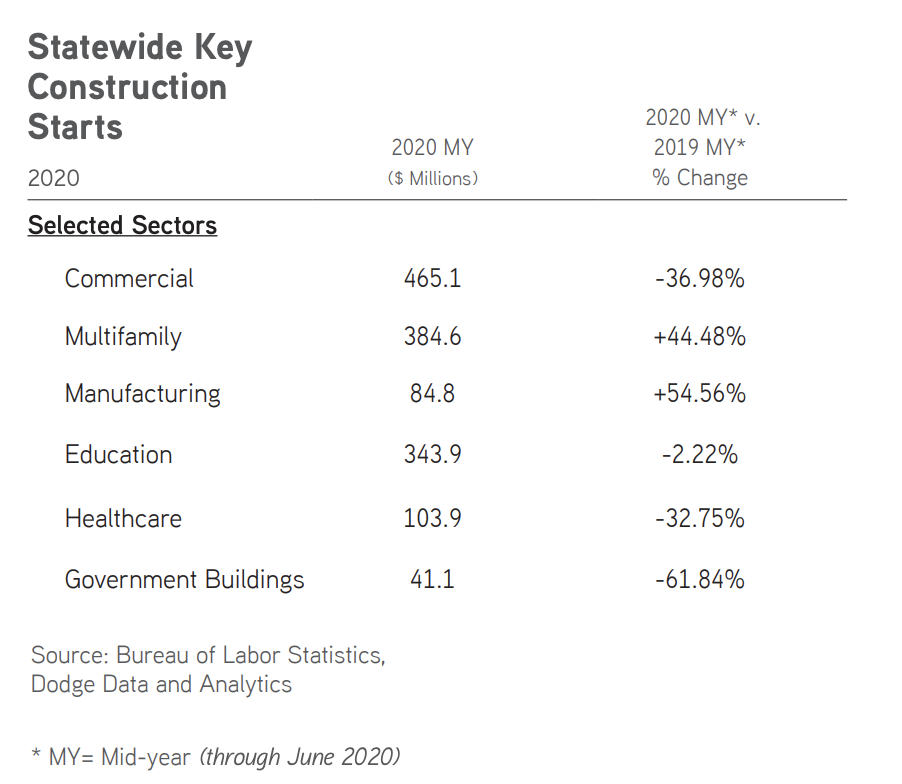

Construction Starts: Statewide construction starts have decreased in four of six sectors compared to mid-year 2019. While healthcare starts increased in the Columbia and Charleston markets, the value of projects is not enough to replace the larger volumes completed in 2019.

Construction Starts: Statewide construction starts have decreased in four of six sectors compared to mid-year 2019. While healthcare starts increased in the Columbia and Charleston markets, the value of projects is not enough to replace the larger volumes completed in 2019.

Construction Workforce: According to the Bureau of Labor Statistics, as of June 2020 there were 108,300 construction employees in South Carolina, 6,700 more than June 2019. The construction workforce declined by 0.82% in March and 5.78% in April, but rebounded in May with a 4.09% increase, followed by a 1.31% increase in June.

U.S. Material Pricing: Pricing volatility entered the market in March after a year of stability. Product shortages along with price increases for certain materials was realized in the Spring. Conversely, pricing for other materials decreased due to lowering demand. Over the past three months, the producer price index for structural steel has increased by 4.77%. During the same time, index pricing for concrete block, crushed stone and gravel, cement, and reinforced concrete pipe has increased from 1.4% to 1.83%. The top five pricing decreases from April-June were diesel fuel, -11.23%, asphalt paving, -5.73%, steel pipe & tube, -5.23%, steel mill products, -3.23%, and gypsum products, -1.8%.

U.S. Construction and Development Lending: According to the FDIC, construction and development loan volume totaled just under $370 billion in the first quarter of 2020, up $16 billion since the first quarter of 2019. The quality of outstanding loans remained constant representing just 0.46% of total outstanding loans compared to 0.45% during the first quarter of 2019.

U.S. Architectural Billings: The AIA Billing Index for architects in the south has dropped from 58 in February to 35.9 in June. Design activity decreased significantly through May, however, all regions of the country showed an increase from May to June. (A score of greater than 50 indicates increased billing activity.)

Key Market Summary

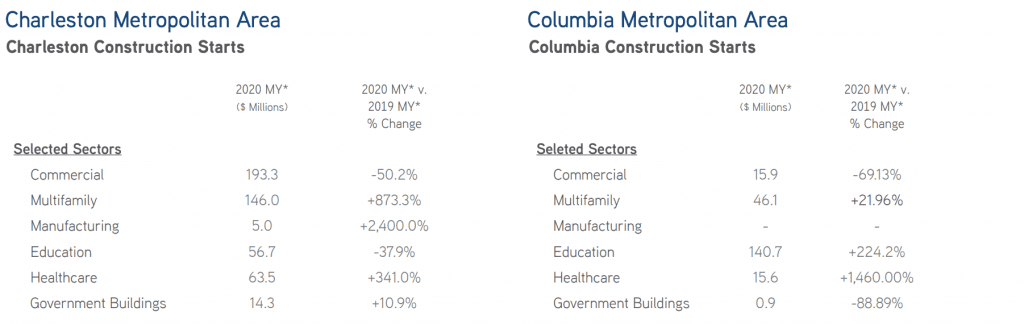

Charleston Metropolitan Area

Construction Starts: Charleston’s commercial sector has experienced a 50% decline in construction starts during the first half of 2020 as compared to 2019. Increases in the multifamily, manufacturing, healthcare, and government building sectors do not necessarily counteract the commercial decline as start patterns within these sectors generally tend to be cyclical. The effect of slower commercial starts will likely intensify as contractors complete their current projects.

Construction Workforce: The Charleston-North Charleston construction workforce has 21,700 workers, a 6.47% decrease over the past year. A loss of 1,400 workers occurred in April 2020, which erased job gains realized in the first quarter. Growth emerged in June 2020 with an increase of 400 workers.

Columbia Metropolitan Area

Construction Starts: Columbia’s commercial, manufacturing, and government building sectors saw a significant decrease in construction starts as compared to mid-year 2019. The education sector is keeping the market energized with +$140 million in construction starts over the past six months. These starts are due almost entirely to public school building programs underway in Lexington School District 1 and Richland School District 2.

Construction Workforce: The Columbia construction workforce had 17,700 workers at the end of June, a 2.7% decrease over the past year. April and May 2020 saw workforce reductions of 11.51% and 3.57% respectively on a trailing-twelve-month basis. Growth in June 2020 corrected this trend and the Columbia construction market now has more workers than in January 2020.

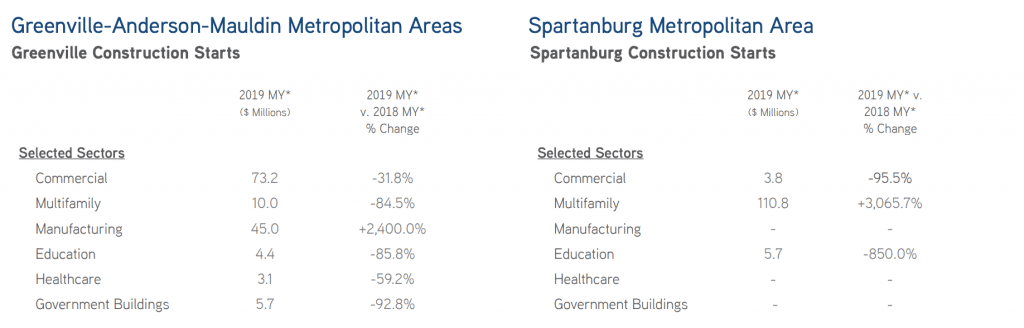

Greenville-Anderson-Mauldin Metropolitan Areas

Construction Starts: Manufacturing is the only sector in the Greenville market which showed an increase in starts. By mid-year 2020, $73 million of commercial construction began in the Greenville-Anderson-Mauldin metro areas, a 31.8% drop as compared to mid-year 2019. The multifamily, education, healthcare, and government building sectors have realized construction start declines ranging from 59.2% to 92.8%. The market can expect a decrease in pricing and workforce as contractors complete an existing backlog.

Construction Workforce: The Greenville-Anderson-Mauldin construction workforce has 19,700 workers, a 5.2% decrease year-over-year. A decrease of 400 workers occurred in April; however, May and June saw growth. Like Columbia, the Greenville market now has more workers than it had in January 2020.

Spartanburg Metropolitan Area

Construction Starts: Spartanburg has seen $110.8 million in multifamily construction starts in the first half of 2020. Starts for all other sectors total $9.5 million with three sectors reporting no starts. As a result, advantageous construction pricing can be reasonably expected in the Spartanburg market.

Construction Forecast

The first half of 2020 saw major marketplace volatility as South Carolina faced the unknown amid the Coronavirus pandemic. Construction starts decreased with commercial construction affected the most significantly. While the work force dropped in the Spring, it has now regained its losses with year-over-year growth. Contractors have enjoyed a healthy work pipeline, but face the potential for workforce saturation if the market continues to slow. Architectural billings reflect the same concern as new projects were paused or stopped earlier in the year, although recent months have shown slight improvement.

The remainder of 2020 continues to be uncertain, although trends are emerging. Due to increased demand, distribution and warehouse construction is on the rise and will likely remain strong for the foreseeable future. It is probable office renovations will increase as employers adjust workplace strategies to include remote working options. Likewise, industries such as medical and food service are working to provide COVID-19 safe environments often requiring space renovation. Healthcare, on a larger scale, along with Higher Education trends remain largely unknown as their capital investments closely follow the impact of the virus. Increased contractor and subcontractor participation in bidding and more competitive pricing can be expected in 2021 as construction starts decline and trades must support their current workforce.

LCK provides professional project management solutions which enable clients to effectively navigate these volatile times. Through creative procurement strategies, cost-management practices, and return on investment analysis, LCK leverages its resources to deliver the most affordable projects to its clients. Attentive, hands-on management at every step results in successful developments delivered on time and on budget.

For additional commercial real estate news, check out our market reports here.