Colliers Report: South Carolina statewide industrial activity intensifies

November 12, 2019Key Takeaways

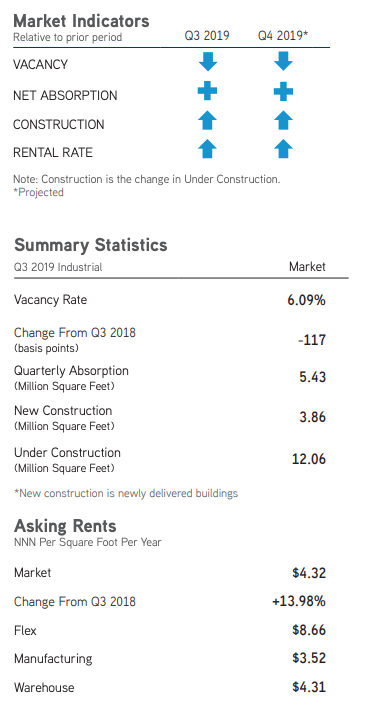

- South Carolina industrial markets continue to absorb record-breaking square footage, this quarter alone the state absorbed 5.43 million square feet.

- Rental rates continue in an upward trend and averaged $4.32 per square foot during the third quarter of 2019.

For additional commercial real estate news, check out our market reports here.

The South Carolina Ports Authority operates the Inland Port Greer, a key transport hub for many Upstate industrial manufacturers and distributors. A 40% increase in container volume from September 2018 to September 2019 confirms its continued record-setting growth. According to the South Carolina Ports Authority, Inland Port Greer handled 12,473 containers this September. Meanwhile, Inland Port Dillon’s container volume increased 33% over its first year of operation in 2018 – during September of 2019 2,541 containers were handled. The South Carolina Ports Authority President and CEO Jim Newsome stated,

“Our fiscal year 2020 is off to a very strong start as we continue to handle record cargo volumes at our terminals.”

Three new ship-to-shore cranes have arrived in Charleston that, once assembled, will be deployed at Wando Welch Terminal in Mount Pleasant and have 155 feet of lift height. The increased number of cranes will allow the South Carolina ports to move large containers back and forth on 14,000-TEU-and-above ships. These cranes coupled with continued focus on “on/off” efficiency will continue to increase the container volume year-over-year. The South Carolina ports system are “worth more than $63 billion in annual economic impact and generate more than $1.1 billion in tax revenue annually,” according to the South Carolina Port Authority.

Market Overview

The South Carolina industrial market is comprised of 438.53 million square feet within 6,917 buildings. From the second quarter through the third quarter of this year, the South Carolina market grew by sixteen buildings which added approximately 3.86 million square feet. In addition, there are 12.06 million square feet under construction and 6.53 million square feet of proposed industrial buildings throughout the market. Despite the delivery of new industrial construction, the South Carolina industrial markets absorbed approximately 5.43 million square feet during the third quarter of 2019 and the overall South Carolina market vacancy rate dropped from 6.13% last quarter to 6.09% during the third quarter of this year. The average triple net South Carolina market rental rate for the remaining available industrial space increased to $4.32 per square foot this quarter.

Augusta | Aiken (South Carolina portion)

The South Carolina portion of the Augusta | Aiken market is comprised of 13.58 million square feet, over half of which is manufacturing space. No new industrial buildings were delivered to this market; however, the 40,000-square-foot AmbioPharm expansion continued construction. The Augusta | Aiken market posted a net negative absorption of 32,655 square feet this quarter which was all in warehouse space. There was no activity in the Flex/R&D sector, nor in the manufacturing sector during the third quarter of 2019. Consequently, the overall market vacancy rate rose to 15.68% this quarter. The average weighted rental rate for the South Carolina portion of the Augusta | Aiken region increased from $2.85 per square foot last quarter to $2.99 per square foot during the third quarter of this year.

Charleston

The Charleston industrial market has 55.64 million square feet of industrial inventory with approximately 4.05 million square feet under construction within 23 buildings. In addition, there are approximately 3.78 million square feet of buildings proposed to be built within the Charleston market. There were three new buildings delivered to the market this quarter which added 470,630 square feet to the Charleston industrial inventory. The Charleston industrial market absorbed 632,810 square feet during the second quarter of 2019; three submarkets: North Charleston, Berkeley County and Clements Ferry absorbed a net total of 540,875 square feet. However, the overall market vacancy rate increased slightly from 8.15% during the first quarter of this year to 8.71% this quarter. The overall market average triple net weighted rental rate dropped slightly this quarter to $5.95 per square foot. The Charleston industrial market has 56.33 million square feet of industrial inventory with approximately 3.74 million square feet under construction within 20 buildings. In addition, there are approximately 13 buildings proposed to be built within the Charleston market which would add an additional 3.88 million square feet to the industrial inventory. There were three new buildings delivered to the market this quarter which added 283,760 square feet to the Charleston industrial inventory. The Charleston industrial market absorbed 300,005 square feet during the third quarter of 2019. Because new construction deliveries surpassed absorption during the third quarter of 2019, the overall vacancy rate increased slightly from 7.49% during the second quarter of 2019 to 7.36% during this quarter. The overall market average triple net weighted rental rate increased this quarter to $6.18 per square foot.

Charlotte (South Carolina portion)

The South Carolina portion of the Charlotte submarket has an industrial inventory totaling 39.20 million square feet, and there are currently 848,784 square feet of warehouse and flex space currently under construction. One 460,800-square-foot warehouse delivered to the market this quarter in York County. The South Carolina portion of the Charlotte market absorbed 683,560 square feet quarter of 2019, led by the manufacturing absorption of 600,952 square feet. The overall quarterly market vacancy rate decreased from 7.42% to 6.77%. Average weighted rental rates for the remaining industrial space decreased from $5.69 per square foot last quarter to $5.41 per square foot during the third quarter of 2019.

Columbia

The Columbia industrial market is comprised of 72.26 million square feet of industrial space. There are approximately 335,000 square feet under construction within three buildings and one owner-occupied manufacturing facility of 660,135 square feet was delivered to the market this quarter. The Columbia industrial market absorbed 627,170 square feet this quarter mostly due to the China Jushi facility in the Southeast Columbia submarket. The overall market vacancy rate remained relatively unchanged from last quarter to this quarter at 5.42% and the average overall market weighted rental rate was $3.96 per square foot this quarter.

Florence | Myrtle Beach

The Florence | Myrtle Beach market is comprised of 38.28 million square feet of industrial properties and absorbed over 1.05 million square feet during the third quarter of 2019. The manufacturing sector absorbed 827,366 square feet this quarter and warehouses absorbed 987,421 square feet and manufacturers absorbed 219,620 square feet. Due to the positive absorption, the vacancy rate dropped from 6.42% to 5.10%. During the third quarter of 2019, warehouse vacancy was 3.26%, lower than it has been for over a year. Construction continues on two warehouses which, upon completion, will add 309,400 square feet to the market. The overall Florence | Myrtle Beach weighted rental rates increased to $3.08 per square foot this quarter due to rising rents within each sector.

Greenville-Spartanburg

Comprised of approximately 208.52 million square feet, there are currently 6.75 million square feet among 22 buildings under construction and 16 additional proposed properties totaling 2.58 million square feet delivering throughout the Greenville-Spartanburg market. During the third quarter of 2019, 3.86 million square feet of industrial buildings were delivered and 2.56 million square feet were absorbed. Consequently, the quarterly market vacancy rate dropped from 5.59% to 5.43%.

Savannah (South Carolina portion)

The Savannah market within South Carolina has 10.29 million square feet of industrial space and absorbed 237,344 square feet during the third quarter of 2019 – most of the positive absorption was within the manufacturing sector. There are currently two buildings totaling 40,000 square feet under construction and no new buildings were delivered to the market during the third quarter of 2019. The overall quarterly vacancy rate dropped from 7.96% to 5.66% this quarter and the average triple net weighted rental rate increased to $4.06 per square foot.

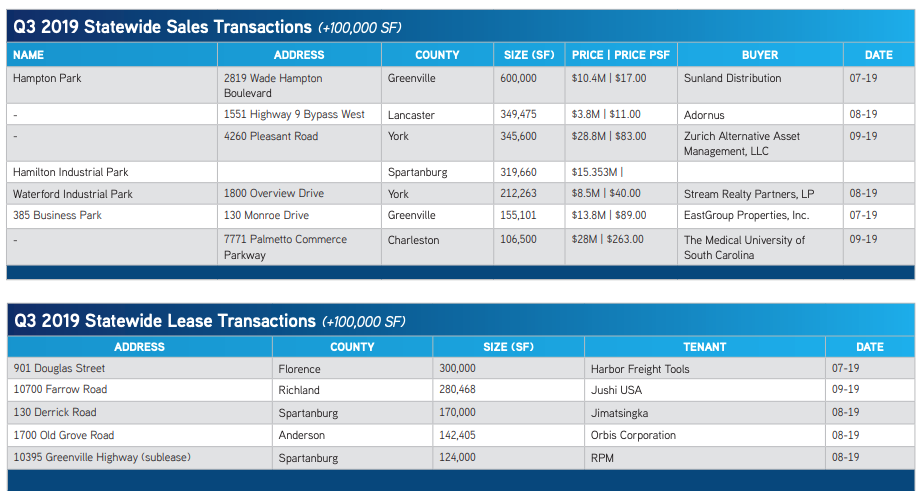

Significant Transactions

There were 116 industrial sale transactions reported through CoStar during the third quarter of 2019, including a $132.61 million, nine-property portfolio sale including a Fort Mill industrial property. There were 74 lease transactions during the third quarter of 2019, six undisclosed leases were over 100,000 square feet.

Market Forecast

Activity in both warehouse and manufacturing sectors is escalating with no signs of slowing in the next couple of quarters. This year South Carolina industrial absorption will be the highest it has ever been. Due to the ports throughout the state, real estate activity is expected to increase throughout next year also. Speculative manufacturing facilities and warehouses are absorbed quickly upon completion throughout South Carolina and investment sales are attractive throughout all markets. South Carolina will draw investors to the market due to attractive rates, increasing deal volume and capital investment opportunities in the market.

For additional commercial real estate news, check out our market reports here.