Colliers Report: South Carolina’s industrial sector is essential during COVID-19

April 27, 2020

Research & Forecast Report

Q1-2020 SOUTH CAROLINA | INDUSTRIAL

Key Takeaways

- Many industrial businesses remain open in order to manufacture and deliver necessities throughout the nation during the Coronavirus pandemic.

- Due to continuing demand, construction will be delayed, but continues despite COVID-19 set-backs.

Demand accelerates within industrial sectors

Demand accelerates within industrial sectors

South Carolina industrial activity is robust; however, the COVID-19 outbreak began altering the supply/demand chain on a daily basis. While many businesses switched to remote work environments, companies involved in the logistics chain were deemed essential. They continued to operate at an accelerated pace in order to deliver goods where they were needed throughout the nation. In addition, some industrial properties are being used for medical supplies or temporarily repurposed in order to make essential medical equipment when possible. While the industrial sectors of commercial real estate may fare better than others due to continued demand, the true effects of the Coronavirus will not be known for several quarters.

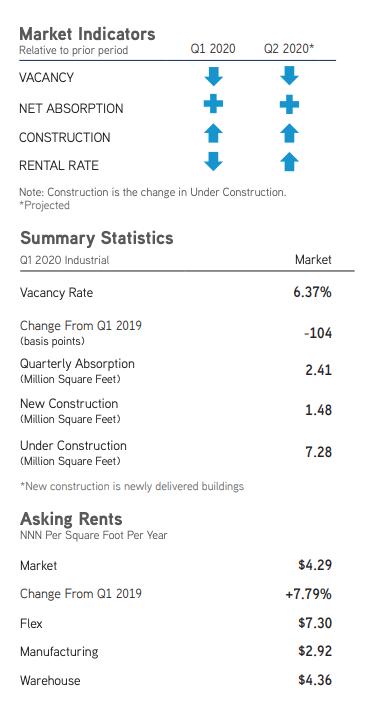

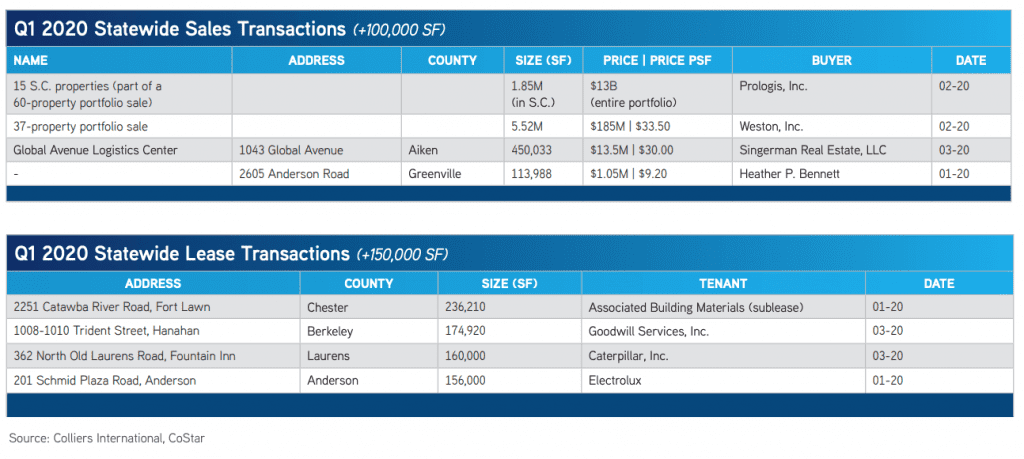

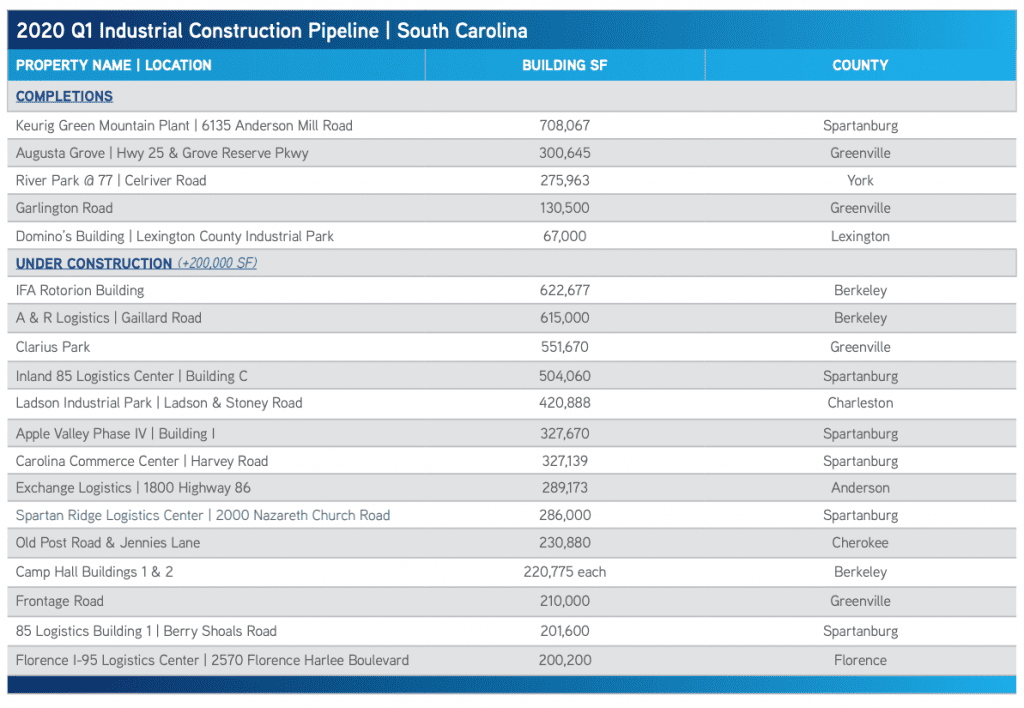

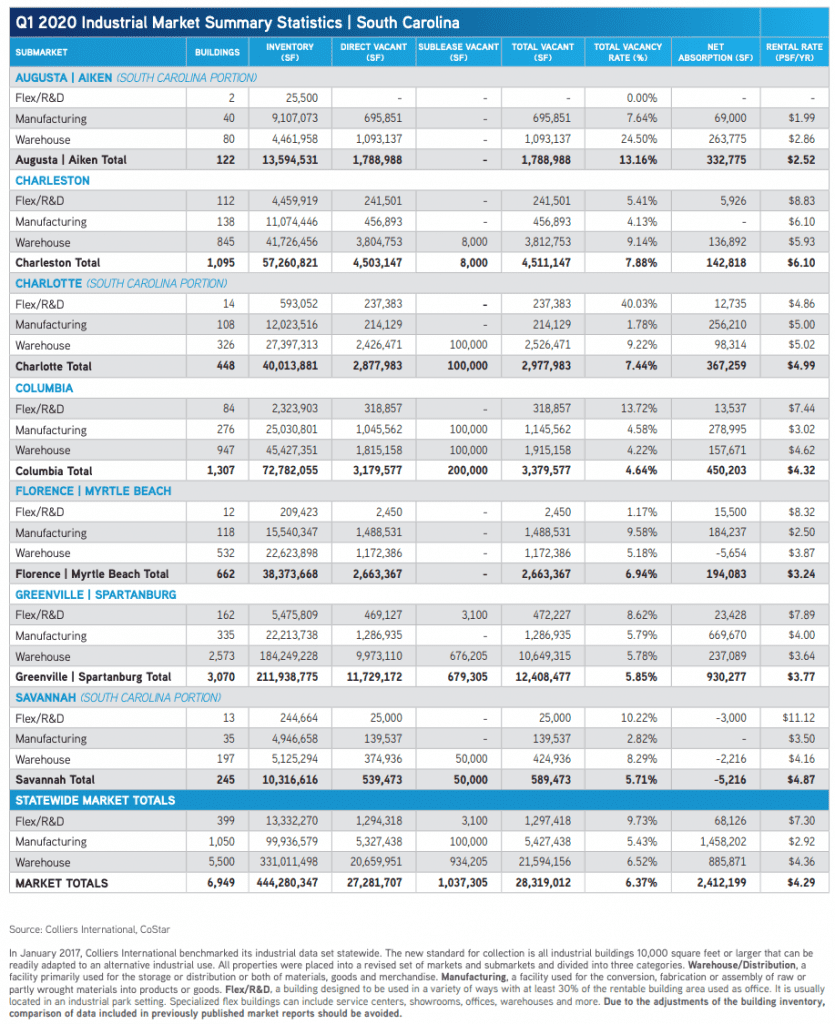

Quarterly Market Overview

The South Carolina industrial market is comprised of 444.28 million square feet within 6,949 buildings. During the first quarter of 2020, the market added five buildings totaling 1.48 million square feet throughout South Carolina. Also, there are 14 buildings proposed to be built which would add approximately 7.58 million throughout the state. Construction activity may be temporarily delayed due to the outbreak of COVID-19; however, demand is high and new construction is expected to complete. The South Carolina industrial markets absorbed 2.41 million square feet this quarter led by Greenville-Spartanburg’s absorption of 930,277 square feet. Positive absorption dropped the vacancy rate from 6.61% last quarter to 6.37% this quarter. The South Carolina triple net market rental rate for the remaining available industrial space averaged $4.29 per square foot this quarter.

Augusta | Aiken (South Carolina portion)

The South Carolina portion of the Augusta | Aiken market is comprised of 13.59 million square feet, over half of which is manufacturing space. No new industrial buildings were delivered to this market; however, the 40,000-square-foot AmbioPharm expansion continued construction. Augusta | Aiken submarkets absorbed 332,775 square feet during the first quarter of 2020, most of the absorption was in warehouse space. Due to positive absorption this quarter, the Augusta/Aiken vacancy rate decreased from 15.61% during the fourth quarter of last year to 13.16% to begin the year. The weighted rental rate for the South Carolina portion of the Augusta | Aiken region averaged $2.52 per square foot during the first quarter of 2020.

Charleston

The Charleston industrial market has 57.26 million square feet of industrial inventory with approximately 2.44 million square feet under construction within 10 buildings. In addition, there are approximately 17 buildings proposed to be built within the Charleston market which would add an additional 4.87 million square feet to the industrial inventory. The outbreak of the Coronavirus at the end of the first quarter may delay construction activity due to businesses temporarily closing and lack of access to construction materials; however, the construction is expected to eventually be completed. There were no new buildings delivered to the market this quarter. The Charleston industrial market absorbed 142,818 square feet during the first quarter of 2020; therefore, the overall market vacancy dropped slightly from 8.13% during the fourth quarter of 2019 to 7.88% this quarter. The overall market average triple net weighted rental rate increased this quarter to $6.10 per square foot.

Charlotte (South Carolina portion)

The South Carolina portion of the Charlotte submarket has an industrial inventory totaling 40.01 million square feet, and there are currently 269,589 square feet of warehouse space currently under construction. One new 275,963-square-foot warehouse delivered to the York County submarket this quarter. The Charlotte market absorbed 367,259 square feet, 256,210 square feet of the positive absorption was within manufacturing space. As a result, the overall quarterly market vacancy rate decreased from 7.72% at year end to 7.44% during the first quarter of 2020. Average weighted rental rates for the remaining industrial space decreased from $5.24 per square foot last quarter to $4.99 per square foot to begin 2020.

Columbia

The Columbia industrial market is comprised of 72.78 million square feet. During the first quarter of 2020 the market absorbed 450,203 square feet. Northeast Columbia was the submarket with the highest absorption of 105,089 square feet, followed by Cayce/West Columbia with 82,312 square feet of absorption. One 67,000-square-foot manufacturing facility was delivered to the market within the Lexington submarket during the first quarter of 2020. There are also two buildings under construction which, upon completion, will add 245,000 square feet to the market. Due to the outbreak of COVID-1 construction is predicted to slow due to lack of materials and several temporary business closings; however, the overall demand is strong enough to expect construction completions on a delayed schedule. The quarterly vacancy rate dropped from 5.17% at year end to 4.06% during the first quarter of 2020. The overall average market rental rate for available industrial space rose to $4.32 per square foot this quarter.

Florence | Myrtle Beach

The Florence | Myrtle Beach market is comprised of 38.37 million square feet of industrial properties and absorbed 194,083 square feet during the first quarter of 2020, most of which was within manufacturing space. No new buildings were delivered to the market during the first quarter of 2020, but construction continues on two warehouses which, upon completion, will add 309,400 square feet to the market. Due to the positive absorption this quarter, the vacancy rate decreased from 7.44% last quarter to 6.94% this quarter. The overall Florence | Myrtle Beach weighted rental rates increased to $3.24 per square foot to begin the year.

Greenville-Spartanburg

Comprised of approximately 211.94 million square feet, there are currently 3.96 million square feet among 20 buildings under construction and approximately 1.12 million square feet proposed to begin construction throughout the Greenville-Spartanburg market. During the first quarter of 2020, 838,567 square feet of industrial buildings were delivered and 930,277 square feet were absorbed. Subsequently, the quarterly market vacancy rate increased slightly from 5.79% to 5.85%. The overall weighted rental rate during the first quarter of 2020 increased slightly over last quarter and averaged $4.66 per square foot.

Savannah (South Carolina portion)

The Savannah market within South Carolina has 10.32 million square feet of industrial space and posted a negative absorption of 5,216 square feet to begin the year. There is one 17,500-square-foot warehouse under construction, but no new buildings delivered to the market during the first quarter of 2020. Due to the negative absorption, the overall quarterly vacancy rate rose from 5.66% last quarter to 5.71% this quarter. Savannah’s triple net weighted rental rate averaged $4.87 per square foot during the first quarter of 2020.

Market Forecast

Industrial activity in South Carolina markets was positive during the first quarter of 2020. Many businesses will adapt to the COVID-19 changes and carry on their operations remotely as much as possible. Demand for manufacturing and logistics will not slow in the near future, because essential businesses need their services.There are currently 7.28 million square feet of industrial buildings under construction throughout South Carolina. Despite construction progress delays during the Coronavirus and temporary business closings-demand is high and construction is still expected to eventually complete. While circumstances seem positive for the industrial sector, the true effects of the Coronavirus will not be evident for many months.A Note Regarding COVID-19 As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate. The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.