Colliers Report: Strong year-end expected in Greenville-Spartanburg as pandemic heightens demand for industrial

October 22, 2020Research & Forecast Report

Q3-2020 GREENVILLE-SPARTANBURG | INDUSTRIAL

Key Takeaways

- The Greenville-Spartanburg industrial market absorbed 1.04 million square feet, decreasing the third quarter’s vacancy rate to 6.64%.

- The pandemic has stimulated multiple market sectors increasing demand throughout the market.

- Greenville-Spartanburg’s market is predicted to finish the year strong due to the deals currently under negotiation and/or closing.

For additional commercial real estate news, check out the Colliers market reports here.

Lifestyle changes fueling industrial sector growth

COVID-19 has stimulated many sectors of industrial activity, thereby increasing demand throughout the Greenville- Spartanburg market. E-commerce, online grocery shopping and the resulting need for cold storage are fueling demand and absorption of well-located and specified facilities designed to meet these requirements. Market demand for this product remains high for both users and investors. Warehouse space close to major logistic pipelines is predicted to continue attracting interest from both investors and owner/users as e-commerce growth increases. While absorption is already positive in the third quarter of 2020, the number of deals currently under negotiation could bring year-end numbers up significantly. Tours for industrial property are rising with renewed interest from out-of-market investors in addition to continued local economic development within the Greenville- Spartanburg market. All of these factors are contributing to increased activity throughout the market going into the fourth quarter.

COVID-19 has stimulated many sectors of industrial activity, thereby increasing demand throughout the Greenville- Spartanburg market. E-commerce, online grocery shopping and the resulting need for cold storage are fueling demand and absorption of well-located and specified facilities designed to meet these requirements. Market demand for this product remains high for both users and investors. Warehouse space close to major logistic pipelines is predicted to continue attracting interest from both investors and owner/users as e-commerce growth increases. While absorption is already positive in the third quarter of 2020, the number of deals currently under negotiation could bring year-end numbers up significantly. Tours for industrial property are rising with renewed interest from out-of-market investors in addition to continued local economic development within the Greenville- Spartanburg market. All of these factors are contributing to increased activity throughout the market going into the fourth quarter.

Market Overview

Greenville-Spartanburg Market

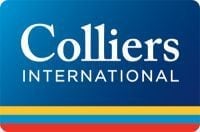

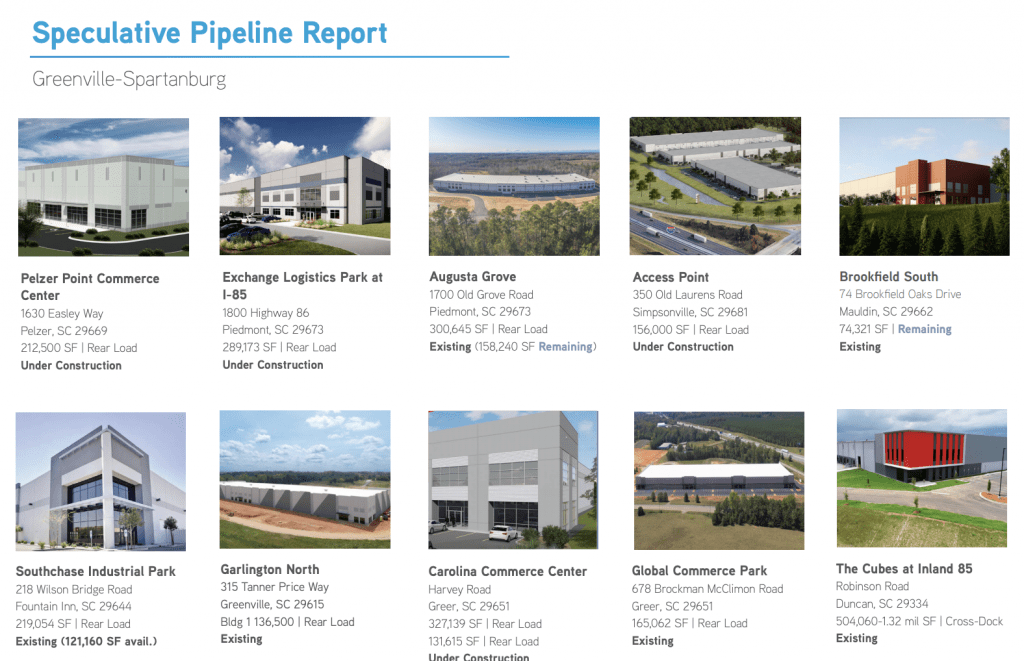

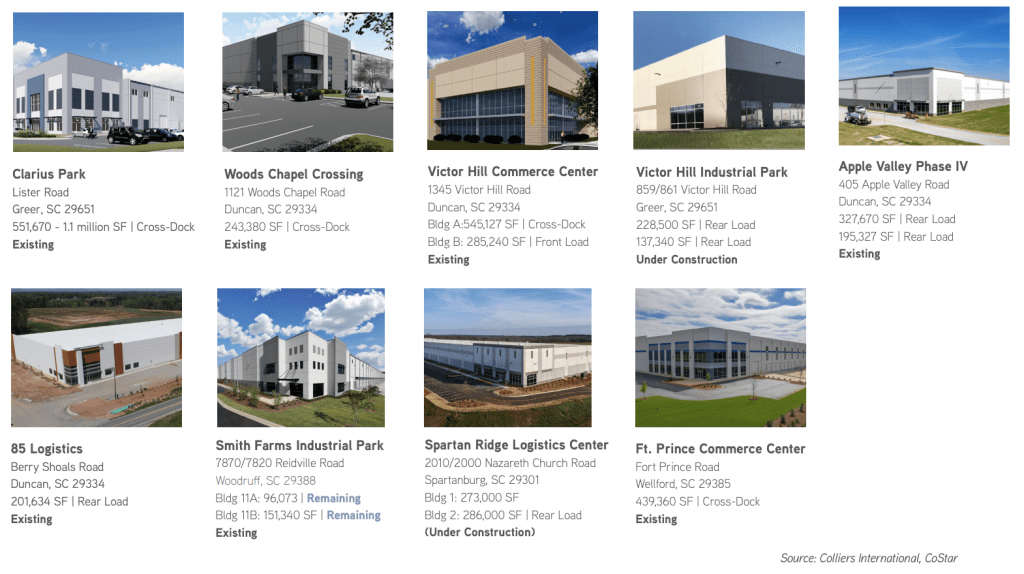

Comprised of approximately 214 million square feet, there are approximately 3.05 million square feet among 16 buildings under construction and approximately 1.88 million square feet proposed to begin construction throughout the Greenville-Spartanburg market. There were no new buildings delivered to the market this quarter. During the third quarter of 2020, the market absorbed 1.04 million square feet. Consequently, the quarterly vacancy rate decreased from 7.12% last quarter to 6.64% during the third quarter of this year. According to Costar, the overall weighted rental rate during the third quarter of 2020 decreased slightly from last quarter and averaged $3.43 per square foot.

Flex/R&D

The flex sector of the Greenville-Spartanburg market is comprised of approximately 5.44 million square feet. There are currently no flex buildings proposed, nor under construction within the Greenville-Spartanburg market. This sector absorbed 12,798 square feet this quarter; therefore, the quarterly vacancy rate decreased from 8.34% last quarter to 8.11% during the third quarter of 2020. The average weighted rental rate increased slightly to $7.84 per square foot.

The flex sector of the Greenville-Spartanburg market is comprised of approximately 5.44 million square feet. There are currently no flex buildings proposed, nor under construction within the Greenville-Spartanburg market. This sector absorbed 12,798 square feet this quarter; therefore, the quarterly vacancy rate decreased from 8.34% last quarter to 8.11% during the third quarter of 2020. The average weighted rental rate increased slightly to $7.84 per square foot.

Significant Transactions

CoStar reported 31 signed leases and 44 sale transactions during the third quarter of 2020.

Sales

- Sealy & Company purchased an 8-property, 1.08 million-square-foot industrial portfolio with properties in both Duncan and Greer, South Carolina for $87.5 million.

- Tindall Corporation purchased 44 acres to accommodate its new $27.9 million pre-cast concrete manufacturing facility in Spartanburg.

Leases

- Fabri-Kal renewed a 300,000-square-foot lease at 1100 & 1102 Piedmont Highway in Piedmont.

- Electrolux executed a 121,000-square-foot lease at 2 Greentree Road in Anderson.

- Contec, Inc. signed a 115,000-square-foot lease at 250 Broadcast Drive in Spartanburg.

- Parkway Products renewed an 83,489-square-foot renewal at 1642 Blue Ridge Boulevard in Seneca.

- Home Depot leased 74,000 square feet at 74 Brookfield Oaks Drive in Greenville.

- GSP North America expanded their operations by 55,963 square feet at 2725 New Cut Road in Spartanburg, bringing the total 171,727-square-foot building to full occupancy.

Capital Investment & Employment

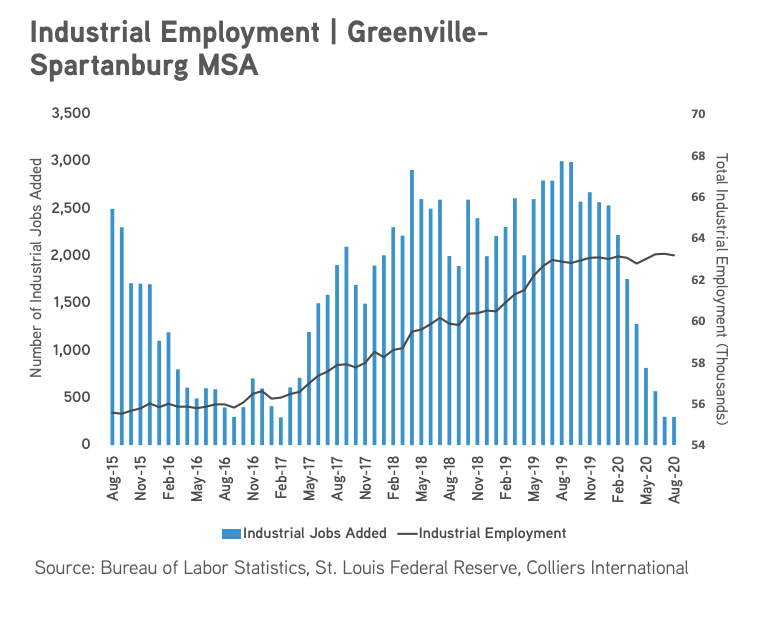

From January through September, 2020 there were approximately $241.7 million in capital investments from new companies, accounting for 410 jobs. Existing company expansions accounted for $85.6 million in new capital, creating 251 additional jobs within the Greenville-Spartanburg region. The types of investments include advanced and engineered materials manufacturing, automotive manufacturing and software, communications and a medical supplier. The Bureau of Labor Statistics data reported there are 298 more industrial jobs than there were in August of 2019. While total employment has decreased by 4,700 jobs over the past 12 months, total employment is expected to normalize as Coronavirus restrictions are relaxed or lifted. The employment rate is steadily increasing month-by-month. As of August 2020, the Greenville-Mauldin-Easley MSA unemployment rate declined to 5.7% and in Spartanburg it decreased to 7.2%.

Market Forecast

The Greenville-Spartanburg market is predicted to finish strong in 2020 due to the closing of many deals currently under negotiation. In addition, due to COVID-19, many consumers continue to increase their online shopping presence expanding the need for warehouse space, especially cold storage units. Manufacturing activity will continue at a high rate due to capital investments and company expansions within the market. There are 3.05 million square feet of industrial properties under construction. While rates have remained relatively steady due to supply they are meeting pro-forma and out-sale or terminal cap rates are more closely mirroring the core markets. As the economy throughout the rest of the United States gains vitality, more activity will likely be pushed through the Greenville-Spartanburg market, thus bolstering the need for more industrial space.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out the Colliers market reports here.