Colliers Report: What will be the impact to the Columbia office market from COVID-19?

June 30, 2020Research & Forecast Report

Q2-2020 COLUMBIA | OFFICE

Key Takeaways

- Despite negative absorption during the COVID-19 quarantine period, Columbia office vacancy rate still remains low at 9.24%. When pandemic restrictions are relaxed or lifted, market activity is expected to return over the next 12 months.

- Less populated tertiary markets, like Columbia, may see less post-Coronavirus changes than major and secondary markets.

The COVID-19 pandemic has altered the operations of almost every type of business throughout the world. Major and secondary markets are likely to change the most, while tertiary markets, such as Columbia, may survive with limited overall changes. For several months quarantine restrictions forced businesses to: shut down, switch to a remote-working environment or minimize operations using essential employees only. Now that restrictions are being relaxed or lifted, the degree to which various markets are affected based on size and population density is becoming apparent.

During a regular weekly commute, employees within major and secondary markets rely heavily on mass transit creating millions of daily interactions. It was, and still is, necessary to remove this aspect for employees due to the Coronavirus, and switch to a remote work environment to eliminate the high-level of social interaction. Businesses unable to accommodate employees working remotely are now either looking to expand their footprint, or working at half-capacity by either alternating work days or using rotating shifts in order to abide by social distancing standards within densely-populated offices.

Conversely, changes within smaller markets may be unremarkable because the population is less dense. The majority of Columbia employees are not reliant on mass transit for their daily commute-they drive alone to and from work. In addition, some companies are choosing to continue working in a remote environment for the time being. However, most will be transitioning back to an office setting with social distancing safety precautions and rules in place to limit visitors and interaction. Columbia tenants interested in footprint expansion due to COVID-19 are lacking options attributable to low vacancy rates and the absence of new office construction. Therefore, many tenants have, or will likely, renew leases at their current location. Other than new rules and social distancing, Columbia office tenants are likely to return to business-as-usual in the next few quarters seeing few other changes caused by COVID-19. Some, however, may choose to seek alternative properties where the tenant controls the environment. A surge in leasing and purchasing direct-entry spaces and free-standing buildings is expected.

Market Overview

Overall Columbia Market

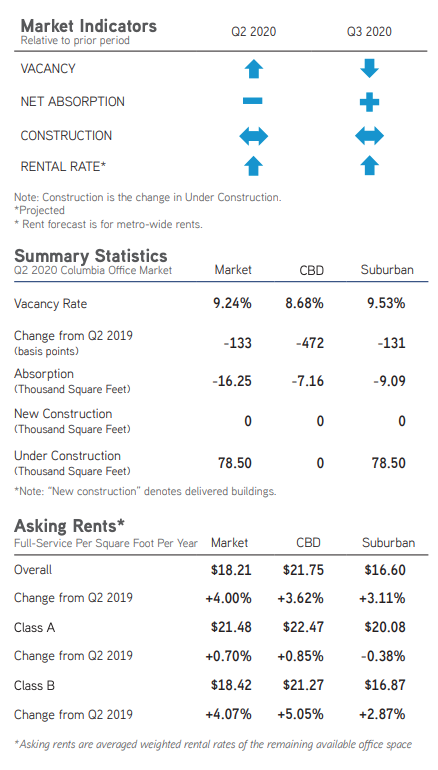

The Columbia office market is comprised of approximately 16.4 million square feet. The Columbia office market posted a negative absorption of 16,248 square feet due to negative Class B office activity. Together Class A and Class C office space absorbed 37,439 square feet. As a result of the overall negative absorption, the overall market vacancy rate rose from 9.14% last quarter to 9.24% during the second quarter of this year. Conversely, Class A market vacancy dropped from 9.46% during the first quarter of 2020 to 8.69% this quarter. The overall market weighted full service rental rates averaged $18.21 per square foot.

Columbia Business District (CBD)

The Columbia central business district consists of 5.56 million square feet. New construction activity is virtually nonexistent. During the second quarter of 2020 downtown offices posted a negative absorption of 7,160 square feet. Class A office space absorbed 11,661 square feet, while Class B and C posted negative absorption. Due to the negative absorption, the central business district vacancy rate increased from 8.55% last quarter to 8.68% during the second quarter of 2020. The overall average full service weighted rental rate in downtown offices rose from $20.36 per square foot during the first quarter of 2020 to $21.73 per square foot this quarter.

The Columbia suburban markets consist of 10.83 million square feet of office properties. During the second quarter of 2020, the Columbia suburban markets posted a negative absorption of 9,088 square feet; however, Class A office space absorbed 21,382 square feet and Class C offices absorbed 10,698 square feet. Second quarter negative absorption pushed the suburban vacancy rate up slightly from 9.44% last quarter to 9.53% during the second quarter of this year. The overall suburban office full service weighted rental rates averaged $16.60 per square foot this quarter. The rental rate averages ranged from $20.50 per square foot in Northeast Class B suburban offices to $11.00 per square foot in Lexington Class B space.

Significant Transactions

According to Costar, during the second quarter of 2020 there were approximately 13 office sale transactions within the Columbia market. There were 29 executed office leases or renewals during this quarter.

Sales

Park West Realty purchased the 49,450-square-foot office building located at 151 Westpark Boulevard within the St. Andrews submarket for $3.13 million.

Nolan Holdings, LLC purchased a 20,822-square-foot, two-property medical office portfolio for $1.48 million.

Market Forecast

While smaller markets like Columbia may see modest changes in a post Coronavirus environment, there will surely be an increase in rental rates. In order for building owners to balance the cost of increased safety precautions and additional janitorial services, office operating expenses will increase pushing rental rates upward in the next few quarters. Minimal market changes and rising rental rates within the Columbia market may present an opportunity for new Columbia construction within the coming years. Also, increased interest from major and secondary market tenants looking to relocate to less dense cities will make Columbia an attractive option in the future.

A Note Regarding COVID-19

As we publish this report, the U.S. and the world at large are facing a tremendous challenge, the scale of which is unprecedented in recent history. The spread of the novel Coronavirus (COVID-19) is significantly altering day-to-day life, impacting society, the economy and, by extension, commercial real estate.

The extent, length and severity of this pandemic is unknown and continues to evolve at a rapid pace. The scale of the impact and its timing varies between locations. To better understand trends and emerging adjustments, please subscribe to Colliers’ COVID-19 Knowledge Leader page for resources and recent updates.

For additional commercial real estate news, check out our market reports here.