Colliers Report: What will take the Columbia office market to the next level?

January 13, 2020Key Takeaways

- The overall Columbia office market absorbed 56,270 square feet from the fourth quarter of 2018 to the fourth quarter of 2019.

- There are less office-using jobs in Columbia than there were at year-end 2018; therefore, the demand for office space is decreasing.

- Columbia’s annual office vacancy rate decreased from 10.73% during the fourth quarter of last year to 9.94% this quarter.

To download the complete report: 2019 Q4 Office Columbia Report

2019 Office Recap

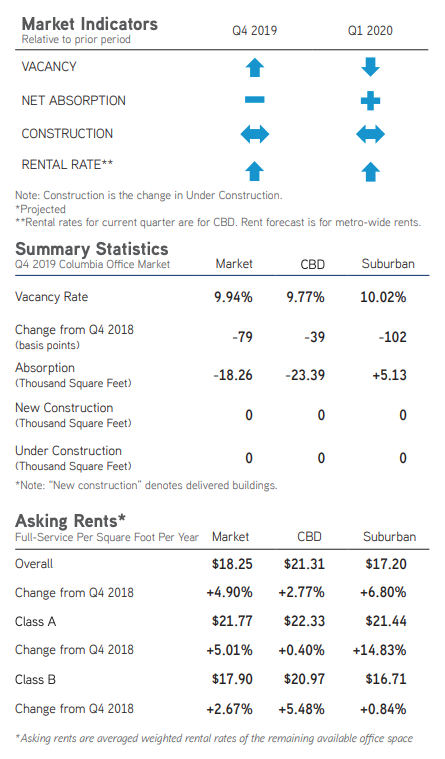

The annual office vacancy rate decreased from 10.73% during the fourth quarter of last year to 9.94% this quarter. Overall, Columbia absorbed 56,270 square feet; the central business district posted a negative 53,488 square feet due to CBD office properties being repurposed or demolished last year. The Northeast Columbia submarket posted the highest annual absorption of 129,134 square feet this year. Throughout 2019, there have not been many options for new leases within the central business district due to the lack of available spaces. The overall average weighted rental rates have increased from $17.36 per square foot during the fourth quarter of 2018 to $18.25 per square foot this quarter. Likewise, Class A overall weighted rental rates have increased 5.01% from this time in 2018 and were $21.77 per square foot, and Class B rental rates increased 2.67% over fourth quarter of last year and were $17.90 per square foot during the fourth quarter of 2019.

The annual office vacancy rate decreased from 10.73% during the fourth quarter of last year to 9.94% this quarter. Overall, Columbia absorbed 56,270 square feet; the central business district posted a negative 53,488 square feet due to CBD office properties being repurposed or demolished last year. The Northeast Columbia submarket posted the highest annual absorption of 129,134 square feet this year. Throughout 2019, there have not been many options for new leases within the central business district due to the lack of available spaces. The overall average weighted rental rates have increased from $17.36 per square foot during the fourth quarter of 2018 to $18.25 per square foot this quarter. Likewise, Class A overall weighted rental rates have increased 5.01% from this time in 2018 and were $21.77 per square foot, and Class B rental rates increased 2.67% over fourth quarter of last year and were $17.90 per square foot during the fourth quarter of 2019.

So, what will it take for the Columbia office market to move to the next level of generating new construction? There are several factors which are needed to have a positive impact on creating new office construction. The market is well occupied and experiencing rental rate increases. Yet the differential between what Class A tenants are currently paying and the rental rate required for new construction is still a large gap. This gap will be reduced in 2020 as we continue to see rental rates increase. Particularly in 2020 we will see rental rates increase at a much higher pace than in years past. The extremely limited amount of vacant space in the Class A and Class B sectors will allow landlords to increase rates significantly in 2020. Yet even with rental rate increases, the single most important component for generating new construction which is missing is the creation of office-using jobs in the central region of South Carolina.

Office-using employment are those jobs related to the professional and business services, financial activities and information sectors. According to the most recent October 2019 data from the Bureau of Labor Statistics, within the Columbia Metro Statistical Area (MSA) there were 1,200 less jobs during October of this year than there were in October 2018, weakening overall office demand in the Columbia market. Total non-farm employment totaled 404,600 within the Columbia MSA in October 2019. Government, Trade, Transportation and Utilities and Professional and Business Services are currently the top three employment sectors contributing to the Columbia MSA employment. The Columbia unemployment rate continues to decrease and is currently at 2.0% as of October of this year.

So, for 2020, landlords can expect to see constant renewal activity within their properties at significantly higher rental rates. Tenants who may be in need of more space find challenges with locating suitable options and if they are located, rental rates will be much higher than they are currently paying. If the market experiences positive job creation, we will then begin to see the foundation for potential new construction of office properties in the Columbia market.

Market Overview

Overall Columbia Market

The Columbia office market is comprised of 16.26 million square feet of office properties within 8 submarkets. No new construction was delivered to the market or is currently under construction, two buildings totaling 95,500 square feet are proposed to be built within the Columbia market. The overall market posted a negative 18,263 square feet during the fourth quarter of this year, most of the negative absorption was concentrated within two downtown buildings. Class A properties absorbed 25,032 square feet and the Northeast Columbia submarket posted 19,688 square feet of absorption this quarter. The vacancy rate rose slightly from 9.82% last quarter to 9.94% during the fourth quarter of 2019. The overall average weighted rental rate in the Columbia office market rose to $18.25 per square foot this quarter, indicating the remaining space that is available in the Columbia market is of high quality.

Columbia Business District (CBD)

Columbia Business District (CBD)

The Columbia central business district consists of 5.56 million square feet and construction activity remains absent. Downtown office buildings posted negative 23,388 square feet of office absorption; however, Class A downtown office absorbed 16,193 square feet. Very few buildings had any activity at all, only 9 office buildings contributed to the overall CBD absorption. The overall downtown vacancy rate increased slightly from 9.35% last quarter to 9.77% during the fourth quarter of 2019. In addition, the overall downtown weighted rental rates increased from $21.15 per square foot during the third quarter of 2019 to $21.31 per square foot this quarter; however, the downtown offices rental rates range from $15.50 per square foot to $25.00 per square foot depending on the location and quality of space. Class A office rental rates averaged $22.33 per square foot and Class B office rent averaged $20.97 per square foot in the central business district during the fourth quarter of 2019.

The Columbia suburban markets consist of 10.69 million square feet of office properties and no buildings were delivered to the market or are under construction within the Columbia suburbs. The suburban submarkets absorbed 5,125 square feet overall, with the Northeast Columbia submarket accounting for 21,663 square feet of the positive absorption and most of that absorption occurred at 1001 Pinnacle Point Drive. The suburban vacancy rate dropped slightly from 10.07% during the third quarter of this year to 10.02% this quarter. The suburban submarkets average weighted rental rate increased to $17.20 per square foot during the fourth quarter of 2019. Suburban rental rates averages ranged from $14.91 per square foot in Class C offices to $21.44 per square foot in Class A offices.

Significant Transactions

This quarter there were 30 sale transactions, according to CoStar. During the third quarter of 2019, there were also 53 leases, most leases were between 2,000 square feet to 5,000 square feet.

Sales

- Casey Management purchased the 88,000-square-foot IKON Building at 7 Technology Circle in Columbia for $6.3 million.

- Cason Development Group LLC purchased the 27,309-square-foot office building at 1813 Main Street for $1.5 million.

Market Forecast

Tensions rise when entering an election year as fears of policy changes and economic downturns mount. However, most economists agree a recession is not predicted to occur in 2020. Columbia’s economy is positive with a low unemployment rate and a steady rise in population and residential growth and will be able to withstand the general economic ebb and flow expected in coming years. One issue which needs to be addressed is the lack of Columbia office-using job creation. Attracting new headquarters and recruiting college graduates to the region will be crucial for continued office demand.

The office market has fluctuated throughout the past year, but due to high quality space availabilities in the central business district and positive growth in the suburban submarkets, it is expected to post positive activity through the middle of next year. As space tightens, the office rental rates will likely rise for the available remaining spaces as tenants compete for office space that suites their needs.

To download the complete report: 2019 Q4 Office Columbia Report