Four Northwestern Mutual wealth advisors receive CERTIFIED FINANCIAL PLANNER™ certification

December 3, 2019Northwestern Mutual wealth advisors Luke Brooks, Joe Funderburk, Thiago Pinheiro and Machaka Young have earned the prestigious CERTIFIED FINANCIAL PLANNER™ certification – one of the most respected certifications in financial services. CFP® wealth advisors are rigorously trained in 72 areas of financial expertise and must accrue thousands of hours of experience prior to earning their certification.

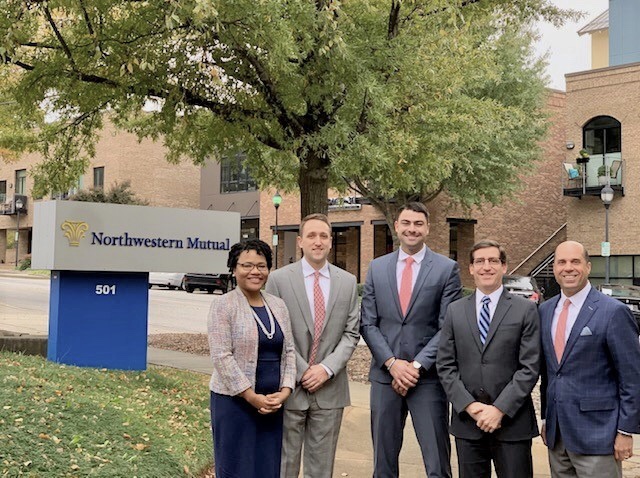

Pictured Left to Right: Machaka Young, Luke Brooks, Thiago Pinheiro, Joe Funderburk and John Tripoli

“Less than 200 female advisors and only twenty-six percent of all financial advisors in the U.S. have obtained the CFP® certification,” said John Tripoli, managing director of Northwestern Mutual. “CFP® professionals have completed extensive training and are held to rigorous ethical standards to help their clients achieve stronger financial security and stability.”

From budgeting, to planning for retirement and education, to managing taxes and insurance coverage, financial planning means much more than just investing. Northwestern Mutual has been serving client’s complex financial planning needs for over 160 years by bringing all the pieces of a client’s financial life together.

“Understanding the complexities of the changing financial climate helps our advisors better serve our clients and with the CFP certification, Machaka, Luke, Thiago and Joe reaffirm their commitment and dedication to serving their clients at the highest possible level,” adds Tripoli.

About Northwestern Mutual

Northwestern Mutual has been helping families and businesses achieve financial security for 160 years. Through a distinctive, whole-picture planning approach including both insurance and investments, we empower people to be financially confident so they can live life differently. We combine the expertise of our financial professionals with a personalized digital experience to help our clients navigate their financial lives every day. With $250.4 billion in assets, $28.2 billion in revenues, and more than $1.6 trillion worth of life insurance protection in force, Northwestern Mutual delivers financial security to more than 4.4 million people who rely on us for life, disability income and long-term care insurance, annuities, brokerage and advisory services, trust services, and discretionary portfolio management solutions. The company holds more than $100 billion of client assets as a part of its wealth management company and investment services. Northwestern Mutual ranks 97 on the 2017 FORTUNE 500 and is recognized by FORTUNE® as one of the “World’s Most Admired” life insurance companies in 2017.

Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company (NM), Milwaukee, WI (life and disability insurance, annuities, and life insurance with long-term care benefits) and its subsidiaries. Northwestern Mutual and its subsidiaries offer a comprehensive approach to financial security solutions including: life insurance, long-term care insurance, disability income insurance, annuities, life insurance with long-term care benefits, investment products, and advisory products and services. Subsidiaries include Northwestern Mutual Investment Services, LLC (NMIS) (securities), broker-dealer, registered investment adviser, member FINRA and SIPC; the Northwestern Mutual Wealth Management Company® (NMWMC) (fiduciary and fee-based financial planning services), federal savings bank; and Northwestern Long Term Care Insurance Company (NLTC) (long-term care insurance).

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. The Chartered Advisor for Senior Living (CASL®) designation is conferred by The American College of Financial Services.