LCK Report: South Carolina Construction Starts are Down

December 9, 2019

Research & Forecast Report

Q3-2019 SOUTH CAROLINA | CONSTRUCTION TRENDS

Key Takeaways

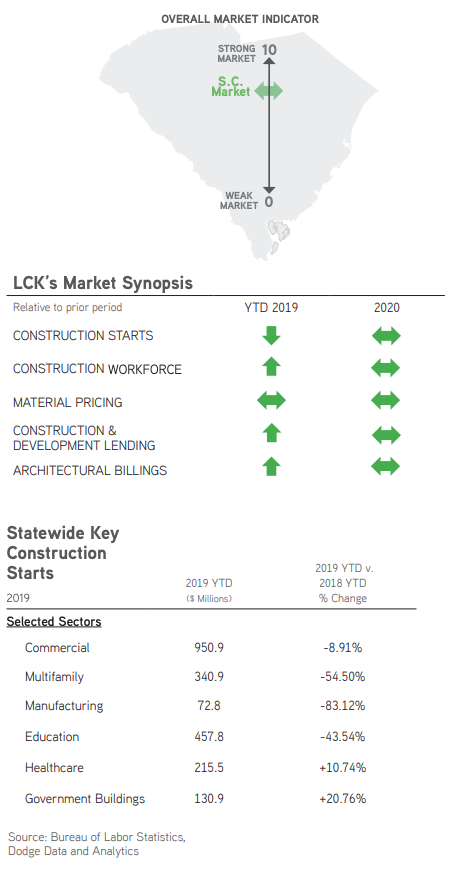

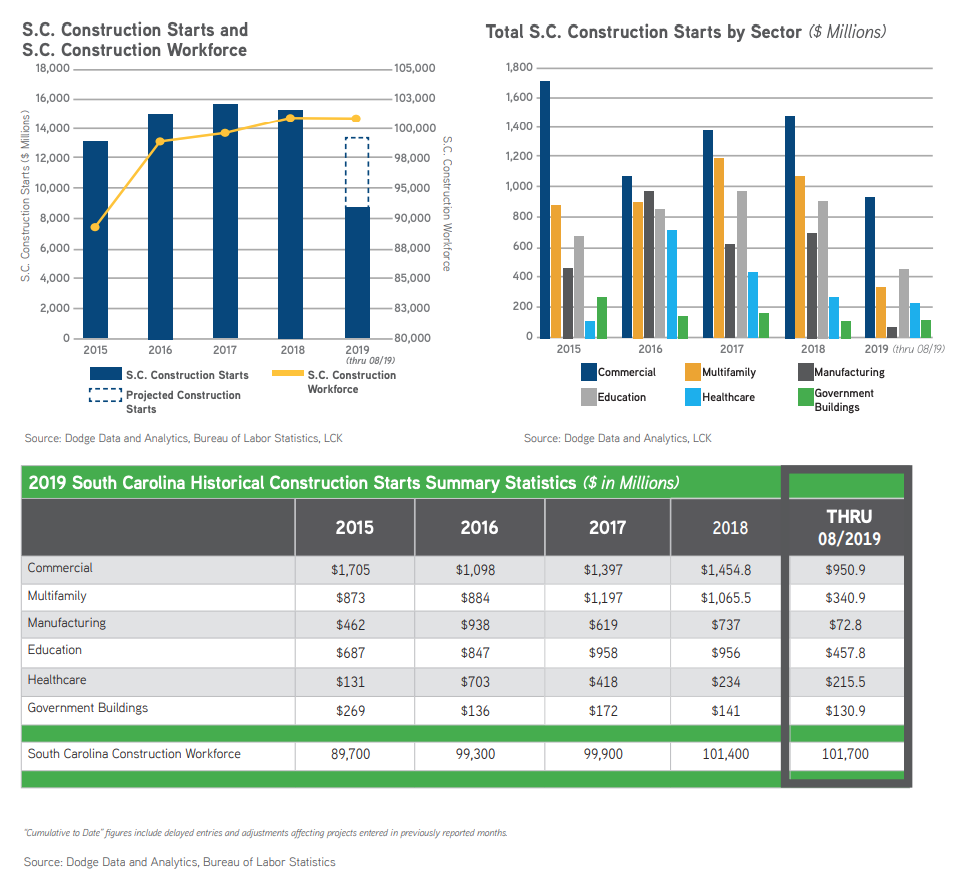

- Statewide construction starts have decreased across most sectors over the past year while indicators tracking pre-development activities are up. Construction activity is expected to remain strong in 2020 with only a moderate slowdown over 2019.

- Construction costs across all sectors are expected to remain steady in South Carolina. Volatility in material pricing has diminished while the backlog of under construction work remains strong.

- LCK Construction Tip: Workforce resources continue to be scarce despite the slowdown in construction starts. Recruitment of design and construction talent remains a challenge. Employers are competing for the best means to attract and retain staff..

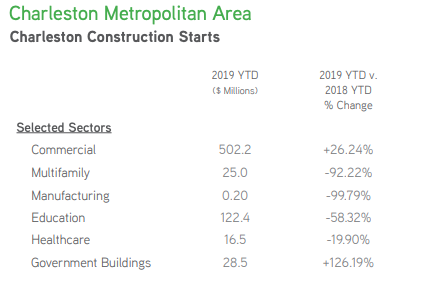

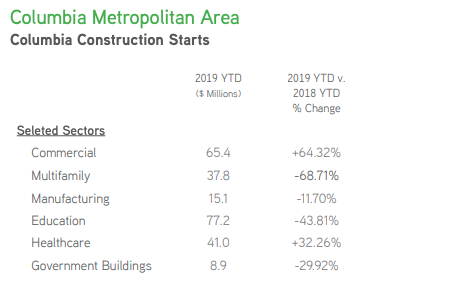

Construction Starts: Statewide construction starts have decreased in four of six key sectors over the past year. Starts for government buildings increased in all of the state’s major markets except Columbia. Commercial construction starts have been strong in both Columbia and Charleston. Manufacturing starts decreased across the state.

Construction Workforce: According to the Bureau of Labor Statistics, as of August 2019, there are 101,700 construction employees in South Carolina, representing 4.66% of the total nonfarm employment. Construction employment has increased by 300 jobs over the last 12 months.

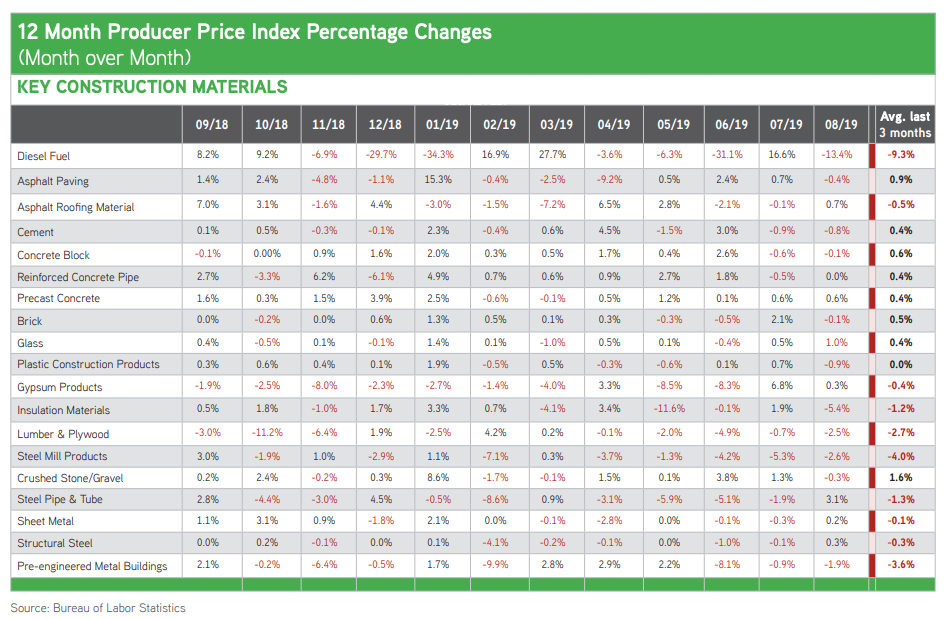

U.S. Material Pricing: Material pricing has stabilized and is expected to continue to be relativity unchanged into 2020. Demand for all types and products of real estate remains high. The FDIC confirms loan volume is increasing but is in a healthy standing for future lending growth.

U.S. Construction and Development Lending: According to the FDIC, construction and development loan volume totaled $357 billion as of June 30, 2019, up $10.3 billion since June 30, 2018. While volume is increasing, the rate of increase continues to ease. Percent change on a trailing-twelve-month basis is at 1.95% compared to a high of 9.24% in the second quarter of 2015.

U.S. Architectural Billings: The year-to-date AIA Architectural Billing Index for architects in the south is 52.3 which indicates increased design activity and points toward growth in future construction starts. (A score of greater than 50 indicates increased billing activity.)

Key Market Summary

Construction Starts: Total year-to-date construction starts in Charleston have decreased in four of six sectors over the past year. The commercial sector boasts a 26% increase in starts valued at just over $500 million. The multifamily and manufacturing sectors show decreases in excess of 90%. The manufacturing sector remains strong despite the trend of decreased starts. A significant backlog, low vacancy, and increasing rents are expected to lead to future sector growth.

Construction Workforce: The Charleston–North Charleston construction workforce has 23,100 workers, a 4.52% increase year-over-year. From August 2018 to August 2019, 1,000 workers were added.

Construction Starts: Four of six sectors in the Columbia market showed a decrease in starts as compared to last year. Commercial and healthcare starts are up compared to a year ago with just over $100 million of construction initiated. Education starts will pick up in 2020 as multiple new schools for Lexington School District 1 and Richland School District 2 are planned to commence construction.

Construction Workforce: The Columbia workforce has 18,000 workers, a 2.27% increase year-over-year. From August 2018 to August 2019, 400 workers were added.

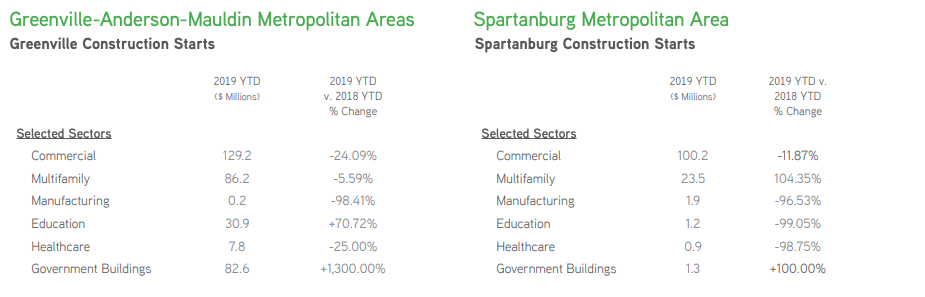

Greenville-Anderson-Mauldin Metropolitan Areas

Construction Starts: Only two sectors in the Greenville market showed an increase in starts over the past year. A steep increase in government buildings starts is due to the Carrol A. Campbell Jr. United States Courthouse, a ten-story federal courthouse started this year in downtown Greenville. As with other markets in South Carolina, manufacturing starts are down.

Construction Workforce: The Greenville-Anderson-Mauldin construction workforce has 20,700 workers, a 6.7% increase year-over-year. From August 2018 to August 2019, 1,300 workers were added.

Spartanburg Metropolitan Area

Construction Starts: Spartanburg’s multifamily and government buildings sectors showed an increase in start growth while all other sectors decreased. School districts within Spartanburg County recently completed several new facilities. As the population grows, so will education starts. Significant manufacturing construction currently underway is likely contributing to low starts. The manufacturing real estate sector remains robust despite lower starts in 2019.

Construction Forecast

Material pricing has stabilized and is expected to continue to be relativity unchanged into 2020. Demand for all types and products of real estate remains high. The FDIC confirms loan volume is increasing and is in a healthy standing for future lending growth.

Positive construction starts vary from region to region but are strongest in the commercial, healthcare, and government buildings sectors. Construction workforce growth is expected to outpace growth in construction starts going forward. However, due to the workforce shortages that have mounted in previous years, the upward trend is not anticipated to relive the strong demand for new workforce in the industry.

Architectural billings are projected to rise into 2020 with increased design activity, thus signaling a continuation of future construction growth.

Institutions, developers, and corporations alike have discovered the advantage of outsourcing project management services to a professional firm such as LCK as an attractive solution to overcome the workforce shortages being experienced in the construction marketplace.

For additional commercial real estate news, check out our market reports here.

To download the complete report: 2019 Q3 Construction Trends South Carolina Report