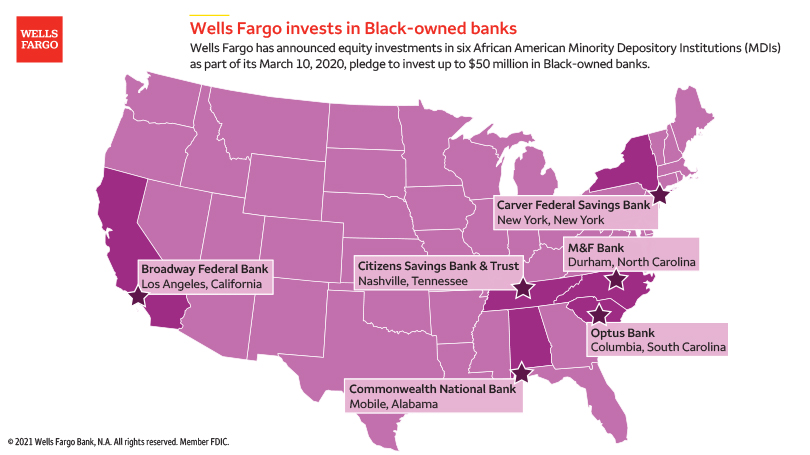

Wells Fargo invests in six Black-owned banks, including Optus in Columbia

February 10, 2021Wells Fargo recently announced equity investments in six African American Minority Depository Institutions (MDIs) as part of its March 10, 2020, pledge to invest up to $50 million in Black-owned banks, including Optus Bank in Columbia. The new partnership would help customers maintain their relationship with Optus by having nationwide banking options if they move from South Carolina.

The six equity investments are part of a March 2020 pledge to invest up to $50 million in Black-owned banks. In the ongoing pandemic, communities of color have been disproportionately impacted, and this investment is part of Wells Fargo’s effort to generate a more inclusive recovery.

“The investment and support from Wells Fargo will allow us to substantially increase our impact on closing the racial wealth gap. We are grateful and committed to ensuring that this capital helps drive transformational wealth building opportunities for our communities and customers,” said Dominik Mjartan, president and CEO of Optus Bank.

Wells Fargo is investing in the following institutions:

- Optus Bank, in Columbia, South Carolina

- Broadway Federal Bank, in Los Angeles, California

- Carver Federal Savings Bank, in New York, New York

- Citizens Savings Bank & Trust, in Nashville, Tennessee

- Commonwealth National Bank, in Mobile, Alabama

- M&F Bank, in Durham, North Carolina

Importance of MDIs in U.S. financial ecosystem

MDIs, some dating back to the early 1900s, serve communities in which a higher share of the population lives in low and moderate income (LMI) census tracts and in which higher shares of residents are minorities. MDIs have played an important role in providing mortgage credit, small business lending, and other banking services to minority and LMI communities.

Equity investment structure

Wells Fargo’s investments are in the form of critical equity capital, which is foundational to the MDIs’ ability to expand lending and deposit-taking capacity in their communities. These are primarily non-voting positions, and are designed to enable the banks to maintain their MDI status. Regarding our commitment being in the form of equity vs. deposits, $1 of new deposits means an MDI can make $1 of new loans, but $1 of new equity means an MDI can make $10 of new loans.

Dedicated Wells Fargo banking relationships

As part of the capital investment, the banks will have access to a dedicated Wells Fargo relationship team that will provide financial, technological and product development expertise in order to support each institution grow and benefit their local community.