Your Guide to Key Performance Indicators (KPIs)

November 19, 2021By Kristen S. Jerome, CPA

Partner, Bauknight Pietras & Stormer

Key Performance Indicators, or KPIs, can be used at any level of any organization to evaluate success toward specified goals. The first rule of KPIs is that there are no hard and fast rules about KPIs:

- There is no standard set of metrics

- Many successful business ventures don’t manage KPIs

- Many successful business ventures not only closely track KPIs, but share them with every single person in their organization

For many entrepreneurs, there is only one KPI – how much money is in my checking account today? However, most mature companies track a few common metrics: (1) cash in the bank, (2) top line revenues, and (3) net income.

If you are starting a business with the goal of selling your business, EBITDA (earnings before interest, taxes, depreciation, and amortization) is a smart metric to track, since it’s a common way to price transactions. Tracking EBITDA may make you more aware of the impact of certain accounting policies you might select (like thresholds for capitalizing assets) and the effect of decisions on a future sales price for your business (your ultimate goal).

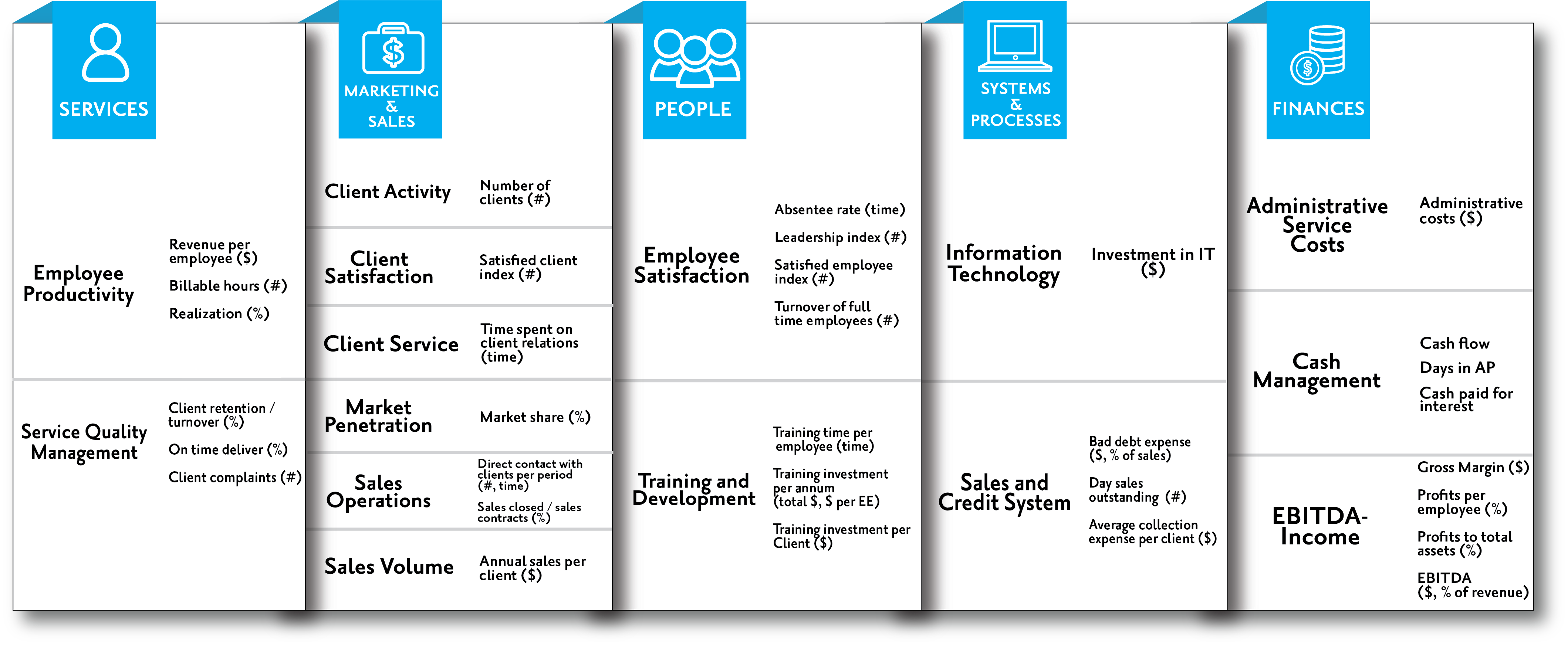

KPIs can measure so much more than financial results; they can measure efficiency, effectiveness, quality, behaviors, personnel performance, customer satisfaction, marketing efforts, and cost of customer acquisition. This list goes on. A set of commonly used KPIs for a professional services firm are outlined in the table at the bottom of the article.

KPIs can generally be categorized as leading indicators or lagging indicators. Leading indicators hint at future results. Lagging indicators measure actual results.

The key to KPIs is selecting the right ones. First, set your goals (I want to lose weight). Then, set targets (I want to lose 30 pounds over 6 months). Now, set your KPIs (leading indicator – I am going to track my calories, with a goal of 1800 per day; lagging indicator – I am going to weigh myself on Tuesday mornings, hoping to lose 2 pounds per week).

KPIs should drive decision–making. Don’t spend the time and effort to track data that doesn’t advise your decision-making. Just because you can track something, doesn’t mean you should. Extraneous KPIs clutter your headspace and distract you from your goals.

A Primer on Key Performance Indicators

KPIs require constant attention. Set them, figure out the most efficient way to measure them, then figure out how to act on them. THEN, periodically evaluate whether they are doing you any good. Some helpful considerations in determining the cost/benefit of your KPIs:

- Is this metric driving decisions?

- Is the metric properly correlated with the goals I set?

- Is the metric calculated correctly?

- Is the data I need to drive the metric readily available? If not, how much would better data cost me?

KPIs can be tracked in Excel or Power BI (free for individual users). There are a number of fancy software packages that package your KPIs into beautiful dashboards. Some CPAs (like BPS) provide advisory services that include selecting and monitoring KPIs.

As Peter Drucker famously said, “What gets measured gets done.” The point of monitoring KPIs is to influence behavior — yours and maybe even your employees. If you set a goal, people will typically do everything they can to meet it — honestly, but sometimes dishonestly, particularly if their compensation hangs in the balance. Think through the unintended consequences of managing certain metrics. Wells Fargo used KPIs that incentivized their people to create fake accounts for customers. Oops. Be aware of unintended consequences and take a balanced approach to selecting KPI targets. Balanced KPIs include most of the following:

- Lagging indicators

- Leading indicators

- Financial metrics

- Non-financial metrics (i.e. employee or customer turnover or satisfaction)

Think about who you share KPIs with. Think about the financial literacy of your audience and control. Share relevant KPIs with the people in your organization that can influence progress towards the goal. If you aren’t transferring authority or ownership for that goal, you are only transferring worry. That is not a good thing to do.

It is not uncommon for very intelligent entrepreneurs, who know everything there is to know about their subject matter, to be scared to death of their financials. The more you look at the numbers, talk about the numbers, understand the numbers, and learn how to manage the numbers (become one with the numbers!), the less scary they become. Undeniably, knowledge is power. KPIs are power tools to drive operational and strategic initiatives.

Two words of caution:

- Some would say if you don’t implement KPIs thoughtfully, you’re better off not using them at all.

- Monitoring KPIs is no substitute for reviewing and understanding your financial statements, bank statements, receivables, and payables.

There are diverse schools of thought on performance indicators. If the topic catches your attention, you may want to head to the library and check out:

The Great Game of Business by Jack Stack and Bo Burlington

No Rules Rules: Netflix and the Culture of Reinvention by Reed Hastings and Erin Meyer

The Tyranny of Metrics by Jerry Z Muller

About Bauknight Pietras & Stormer, P.A. (BPS)

Established in 1991, BPS is among the Southeast’s premier accounting and consulting firms and among the largest locally owned public accounting firms in South Carolina with 50 Certified Public Accountants and 30+ professional staff. BPS is a strategic partner to clients in the insurance, construction and real estate, employee benefits, hospitality, manufacturing and distribution, professional services, telecommunications, and technology industries. BPS is a member of Prime Global, an association of private accounting firms, and was recognized as one of America’s 50 Best of the Best Firms in 2020 by INSIDE Public Accounting, the top tax advisory firm in the U.S. by Captive Review, and in 2019 was recognized by Forbes as among the top recommended tax and accounting firms in America. Learn more at www.bps.cpa